I was surprised they didn’t sue Dr. Ashwath Damodaran when he

opined that ITCs bestdays are behind it.

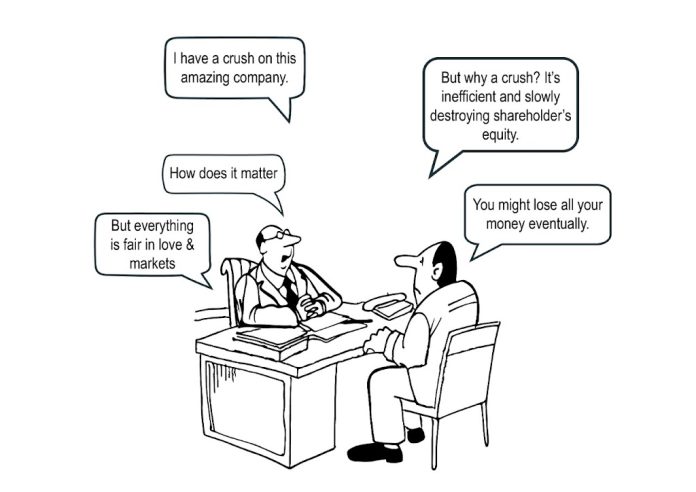

We have all had crushes during our school

days and almost always our crush would just create a flutter, never materialise

into anything meaningful, we would try and attract the person’s attention,

protect them fiercely (without the same mattering to the subject), it would

always remain a sweet memory, would eventually fade into oblivion without

giving any carnal or emotional happiness but You won’t ever hear anything

against it.

Well that’s the story of ITC’s

shareholders and how this amazing company with an infinite potential will

eventually take an entire generation of dividend lovers down with it and would

become a case study just like The General Electric.

History is replete with examples of

companies that got consumed by hubris because they had no real owner, no one

was answerable, shareholders had no say, the management had no skin in the game

and the board was only self-serving to ensure that their own compensation was

secure – to hell with shareholders.

Now a few of You while reading this

would be euphoric about this momentary surge in the share price over the last

few months and the celebrated dividend yield. Little realising that when

shareholder’s equity/capital is invested, the purpose of the same is to

consistently enhance return on equity at an attractive IRR, but not set the foundation

for permanent capital destruction.

General Electric, Enron, Indiabulls,

…. (the list is infinite) are just a few examples where dividend yield kept the

hopes of the romantics (shareholders) alive while consistently destroying

shareholder’s wealth.

There are more than many companies

that provide adequate capital protection, better corporate governance, great

dividend yield and ‘far far’ better capital allocation strategies – but that’s

for another day.

For the longest period of time GE was

the most respected company, Jack Welch the most celebrated leader (the folklore

goes that his Salmon for lunch would fly in from Norway in Company’s private

jet – obviously at the shareholder’s expense), could do no wrong. His word was

the gospel truth in management and leadership, people loved the dividend yield

and yet he set the stage for its eventual demise. This got discovered much

after he was gone.

And while there were so many instances

of 30-40% surge in its share-price since 1990, GE eventually reached where it

was destined to – NOWHERE.

And anyone thinking that ITC will create any shareholder wealth, will have an

ever-increasing ROCE, will be disappointed and this piece will go down in

history as the most momentous piece. For no amount of defamation suit can

possibly muffle the logic or the sound reason behind a compelling argument. And

the liberty provided to me by my constitution u/s 19 is

obliged to fiercely protect this right.

I was amused when ITC gave a 10 hr investor

presentation last year. Companies that cant face shareholders, give 10 hr long “one-sided”

presentations that can barely pass the muster of being more than a new

employee orientation presentation, one-way communication trying to justify the

underperformance in the garb of future potential.

Most Promoters would resonate with what

I am talking about – when employees hoodwink boards and shareholders by their

specious Annual Operating Plans by presenting a 10 year vision and a large part

of that vision would reach fruition only towards the later part of that plan.

As someone clichédly said “more fiction is written on PPT’s and Excel Sheets

than by Rowling or Dan Brown”.

I actually have very vivid memories of

a sales professional who worked for me (not too long ago), who would always

promise a brighter future just a few years down the line. I had the luxury of

knowing that person for 8-9 years so would always end up musing about the

missing results of the actions that were taken 9 yrs ago that were to fructify

into profits/performance 6 years ago – the saga went on and on. But yes,

companies and professionals on their eventual irreversible decline almost

always say that the worst is behind us, all is sorted, future is bright and

everything will fall into place just a few months before the superannuation.

Readers of this piece who invest in the

markets and have reasonably good memory can well relate to “the worst is behind

us” narrative peddled by a PSU bank and an automobile company. Unfortunately, for

years and years this narrative alone has been enough to mislead the

shareholders. (This for another time and another piece).

But let this all not just be a

narrative. Let’s get to the numbers and the real performance because numbers

don’t lie.

For the longest period of time ITC has

been peddling false narratives about their capital allocation (masked

destruction) and a faraway lala utopian land. Most of my argument

against their questionable narrative perpetrated over time has been called out

in my 2 earlier pieces

10

Blunders – One arrogant company ( Millions of Shareholders Suffering ) – The

story of ITC

And

Magic

Illusion or Just trickery – The story of ITC

But really as a minority shareholder i

can see and strongly opine, if ITC was to just sell out their entire gamut of

FMCG and Hospitality businesses to either Nestle, Britannia, Adani or Unilever

and hotels to IHCL or Oberois (Under the blessings of Reliance) they can

probably save the company – but the self-serving board of ITC would technically become redundant if they

actually put the company on the path of propriety … Simple.

The chart below is a glaring evidence

of abysmally low return ratios in the hospitality business and the FMCG

business. One wonders, had the cigarettes not been subsidising everything else,

the managers would have successfully bankrupted these 2 divisions long ago. To

be fair to the line managers including the CEO’s of the divisions, they are

nice guys – professional – but completely out of control because they can’t

handle the burden of their division’ legacy and bloated balance sheets.

Most of the alleged growth is coming

from Agri Business over the last few years – at ever depleting margins. For the

record the Agri business operated at an abysmally low EBIT of 5.5% in H1 FY 23,

6.6% in FY22 vs 7.1% in FY21 – Margins are consistently shrinking when the

entire corporate world had the best of the last 2 years. This is a reflection

of poor managerial governance.

Agri Business (as per H1 FY 23 B/S) is

~Rs. 6,000 Crs in assets. Assuming it is a depreciated value at 12% per year

for last 10 years, the real capex made is ~Rs. 22,000 Crs. [ 6,000/(1-r%)^n)].

Assuming this capex was done equally over last 10 years, at an IRR of 13%, this

would have been ~Rs.40,000 Crs worth of equity, but currently it is only

generating Rs. 1,200 Crs of annual EBIT at 3.0% efficiency whilst the GOI bonds

are generating upwards of 7%. It doesn’t take an expert to figure out what this

means and what these numbers are hiding.

Taking credit for increase in cigarette

sales.

Can a well-meaning manager at ITC take

credit for more people converting into smokers or a smoker, smoking more

cigarettes than ever before. And if cigarettes sales are increasing thereby

increasing profits – it’s just plain luck for that division’s P&L and

Balance Sheet.

ITC is doing exceedingly well and

turning around while generating a handsome dividend yield.

This argument is pushed more than

often by all analysts and Fund Managers in media.

The other side of the same argument very

convincingly sounds –

ITC has lost the plot because after

investing Rs. 1,77,000 Cr of shareholder wealth and putting it in jeopardy, (Numbers and arguments in the later part of

this article), ITC is still at the bottom of the stack in all operational metrics.

CHARTS

Top FMCG companies when compared with

ITC

ITC’s EBIT Margins continuously lag

due to highly commoditized products (Atta), subdued margin profile as other

product lines are category challengers (Biscuits, Noodles, Cosmetics etc.). Koi

puche inse – bhai muddat ho chali hai – kar kyaa rahe ho jo itna boora haal

hai.

Top listed Hotel companies compared

with ITC Hotels.

EBIT and EBIT Margins continue to lag

when compared with the peers, for e.g. in FY21 and FY 22, it has the highest

EBIT loss and EBIT Margin is negative, implying higher fixed cost structure and

lower operating leverage. Also, even after the industry’s pent-up demand since Feb’22,

the EBIT Margins still reek of inefficiencies.

The only solution to all this is a

cluster of some serious, young, experienced and well educated outside

professionals on the board that put a stop to the empire building and stop the

equity haemorrhage thereby protecting shareholder’s interest.

Personal empire building must stop and

the adage “Our Ex Chairman liked hotels” must be replaced by a cutting edge

uncompromisable quest for Return on Equity. Division heads should be clearly

told to operate and expand without dipping in papa’s pockets. That’s when ITC

and its downstream divisions will come off age.

But then the party must stop for

inefficient managers. Is ITC ready for that? In my opinion it never will be –

till they reach a stage where they don’t have sufficient cash to pay liberal

dividends and dividend yields start to plummet.

Disrespect For Free Cash

Take for example the acquisition of

Mylo (a company involved in digital marketing?) at a valuation of 400 Cr. A

company that presently does Rs. 3.4 Crs in sales with a PAT of Rs. (minus) -15.9

Crs has been valued at 400 Cr. And ITC wasted 40 Cr of shareholder wealth for 10%

of equity in this company for what? Could India’s best digital marketing company

not be given a professional contract for the same value add with quantifiable

deliverables? Is Mylo giving any service for free to ITC? My only recollection

of Mylo is Jim Carrey’s puppy in ‘The Mask’.

Delve deep through discovery of data and

I would not be surprised if some vested interests are at play.

Hotels

Hotel Assets (as per H1 FY 23 B/S) are Rs. 7,500 Crs. Assuming it

is a depreciated value at 12% per year (blended for the purpose of brevity) for

last 10 years, the real capex made is ~Rs. 27,000 Crs [7,500/(1-r%)^n)]. Assuming this capex was

done equally over last 10 years, at an IRR of 13%, this would have been worth

~Rs. 50,000 Crs of Shareholder’s Funds, but currently this investment is only

generating Rs. 227 Crs of TTM EBIT. Which incidentally includes all the

revenues from all the expansion and chest thumping management contracts that are

being signed to masquerade itself to be a fast-expanding hospitality brand.

Assets (as

per H1 FY 23 B/S) is Rs. 13,000 Crs. Again, assuming it is a depreciated value

at 12% per year for last 10 years, the real capex done is of ~Rs. 47,000 Crs

[13,500/(1-r%)^n)]. Assuming this capex was done equally over last 10 years, at

an IRR of 13%, this would have been ~Rs. 87,000 Crs worth but currently it is

only generating Rs. 1,000 Crs of annual EBIT.

Destroyed Capital

If this Rs. 1,77,000 Crs (approx. 21.5 Billion USD) (Agri : Rs. 40,000 Crs + Hotels Rs. 50,000 Crs

+ FMCG Rs. 87,000 Crs) was simply put in govt of India bonds with annualized 7.5%

per annum, the same would fetch ~Rs. 13,275 Crs viz a viz the present cumulative

~Rs. 2,475 Crs per annum with underlying capital/capex permanently destroyed

unless monetised at a later stage.

The only viable solution out of this persistent and incurable

inefficiency is to respectably monetise its hospitality division and sell it to

either IHCL (a far more efficient organisation) or to Oberois that really know

how to efficiently manage hotels, create cutting edge globally recognised brands

and are on a sustainable expansion spree. I believe even Lemon Tree would do a

better job.

And Unilever / Nestle would be happy,

in the interest of scale, to acquire, and probably pay a respectable premium

for the FMCG division of ITC. But above all there would be no better suitor

than Adani Wilmar or Reliance Retail for which ITC-FMCG will provide a much-needed

backward integration (largest retail chain), efficient operations and a respectable

exit / face saving for ITC.

Here is another prediction

The

Board of ITC will never ever demerge its divisions because that will put an end

to the party that has been going on as division heads will have to become self-sufficient,

raise capital, manage debt and above all answer to shareholders when industry

benchmarks of performance aren’t met.

History will be unkind to BAT, LIC and

SUUTI with combined ownership of 52.66% (BAT : 29.22% LIC: 15.57% and SUUTI :

7.87% respectively) which continue to see a gradual haemorrhage of the

intrinsic value of this company that has amazing potential and an opportunity

to resurrect itself from the path of permanent destruction.

If ITC doesn’t get its act together,

doesn’t stop muffling the voice of reason and logic, continues to waste its

cash on lawsuits, the day isn’t far when the dividend yield might still remain

an attractive 5%, but the share price is much much lower and expense on

defamation suits would be a significant line item in its expense statement.

Price vs Reality

Dr Ashwath Damodaran, popularly known

as the God of Valuation, was hailed when Zomato exactly touched the price that

Dr. Damodaran put as its fair value. And according to his metric as per the valuation

lecture of July’2019 valued ITC at Rs. 170

(https://pages.stern.nyu.edu/~adamodar/pdfiles/country/val2dayIndia2019.pdf). Using

the same methodology, we arrive at a price of Rs. 206 as below.

Sum of the Parts Valuation as on date :

The cottage industry of the ITC memes might not be dead yet and the thunder of these memes’ last laugh might yet be heard.

Excellent analysis this is how professional are enjoying best of both worlds high salaries perks stock options and destroying wealth for the shareholders