And why the global NRIs must protect their fortunes while they can..

“We are hardwired for optimism. We have a natural tendency to believe that things will go well, even when there is evidence to the contrary. This can lead us to underestimate risks and to make decisions that we later regret.” – Nassim Taleb

As I recently partied for many continuous evenings at Ruby Hill (an affluent gated community) in Pleasanton (A suburb of San Francisco), I had the good fortune of meeting a sea full of accomplished Indian Diaspora most of them second-generation immigrants whose parents would have landed on the shores of ‘then’ The Greatest Nation on Earth, worked hard, saved harder and raised extraordinary progeny.

Their kids inherited the resolve of their parents, acquired a good education, worked even harder, demonstrated the hunger to reach the top of the pecking order, and started to indulge and party (and it made me feel quite chuffed to see white servers in these parties – with a secret feeling of empire strikes back) and it worried me to see that naturalization into the local culture and habits swayed away the achievers from the very traits that placed them there.

In all conversations that I have with people, I end up drifting toward opinions on finance, the economy, current affairs, and the zeitgeist. And one thing moved me – the perpetual bullishness towards life, the belief that nothing can go wrong with the USA and above all USA knows how to figure it all out.

And that’s when I remembered this famous quip by – Baruch Spinoza

“Men are not more ready to believe what they know to be true than to wish that what they believe is true.”

So, as I nursed my drink one evening just appreciating these near 10 M $ homes, one guy walked up to me, in continuation of a previous conversation, and said – ‘there is no going back and the USA has gone way past the point of no return in its hegemony and to being a global superpower – but I think we will somehow figure it out as we have always done.’

And, “We will somehow figure it out” encouraged me to pen my thoughts here..

History has it that everything is cyclical and empires rise and fall. The Romans, the Dutch, the British, and now the USA.

Ray Dalio of Bridgewaters articulated his credible theory on the rise and fall of empires in this presentation that opens our eyes to the stark reality and the dangers facing us.

The ovarian lottery of being in our 40’s to 60’s at this age and stage of evolution on earth is one thing to be happy about but being in the USA just when it is orchestrating its own demise (debt, wars, misplaced foreign policy, wokeism, pronouns et al) could be the biggest danger that presents itself to a generation that has worked so hard, to reach where it has reached, and to see it all dangerously threatened just because the policymakers do not have the moral audacity of righteousness and decided to party hard and get entrapped in short-termism while holding the mantle of leadership and decision making for one of the most progressive and advanced nations on the planet.

The 10 reasons why USA has set itself on a path of permanent economic and social demise that will eventually turn it into a Banana Republic and why the diaspora (especially Indian) that has alternate choices – must exercise them.

- Debt

I revere Warren Buffett to death and would give my life, for a month of internship at Berkshire. But I find his most famous quip “Whatever you do don’t bet against America” in sharp intellectual contrast to his most famous advice against leverage where he says “Leverage is the easiest way to go broke”

If USA was a company and its balance sheet was to be rated or evaluated, it would be lucky to get a “CC” (Double C – Extremely high speculative. There is a very high probability of default on financial commitments) rating on its Balance Sheet.

How can a prudent investor do a ‘buy and forget’ and bet on (or not bet against) one of the most stressed balance sheets (of USA) on the planet??

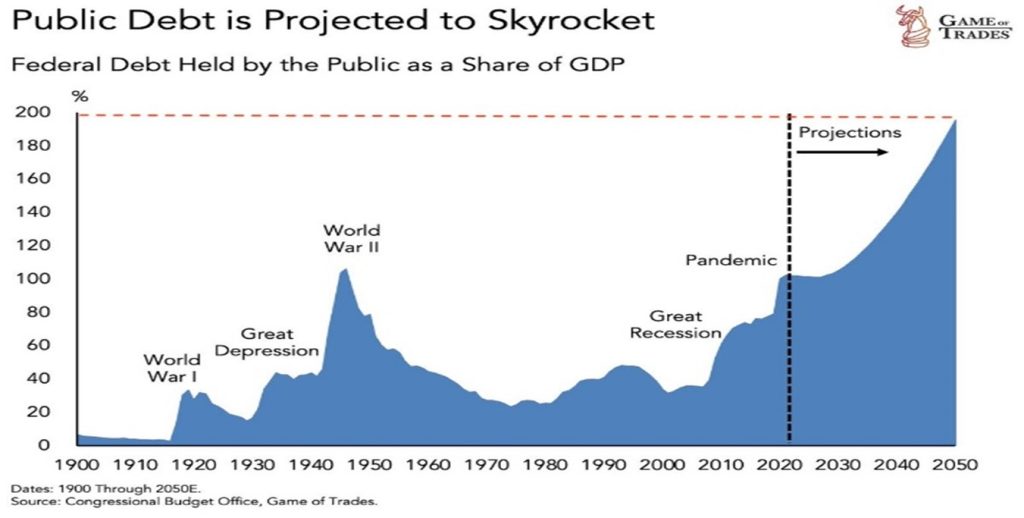

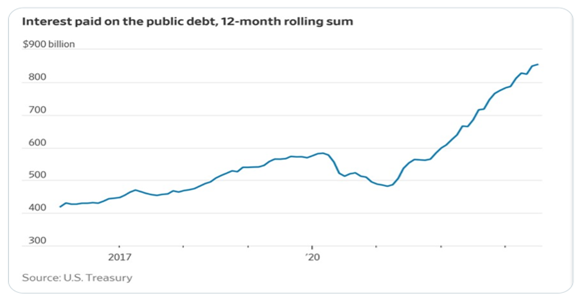

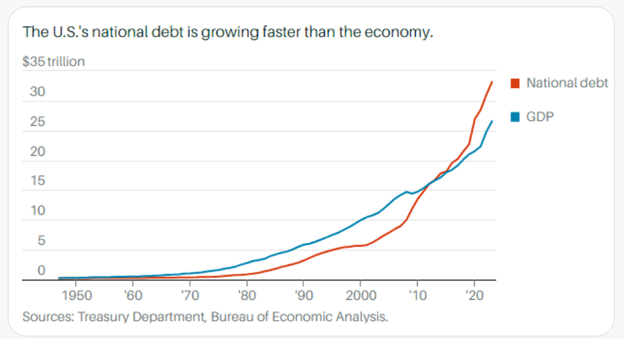

‘The 7 important Charts / Indicators’

The 7 charts above present the grim reality of the situation and need no explanation. But let me simplify it. Imagine that a bank allows you to make a credit card in your unborn grandchild’s name with a limit that is about 250,000 USD. The interest on the CC will get accrued throughout its life and during the lifecycle of the card there would be a few cycles when interest rates per annum would be as high as 22% (as they are today).

A whopping 3.5% of GDP (approximately USD 1trn) is presently being paid as interest on US debt of 34 Tr $ (Bonds and Treasuries) for which there are hardly any international takers left, (as demonstrated by the fastest fire sale by China and Saudi) and all of this debt has to be refinanced at approximately at 1900% extra cost, a few quarters down the line when the present debt matures.

And, an average American is converting the money from their savings and checking bank accounts into high-yield government debt for the promise of better yields.

Even Charles Darrow would be churning in his grave to see this version of Monopoly being played by 330m Americans

It’s difficult for 73% of Americans to make 2 ends meet, how can their grandchildren ever pay the principal and accumulated interest 50 yrs. down the line.

And the irony is that you can only spend a fraction of this credit limit on yourself. The rest is used to pay the salaries and indulgences of the lawmakers and not to forget the wars such as Afghanistan, Ukraine, Israel et’al.

The principle of debt is simple. You take on debt that is an affordable fraction of your known sources of income, to acquire, say a house, car, etc, (and if you are prudent – only appreciating assets) work hard to pay it off – but never default.

America has gone way past the point where its income can cover the servicing of its debt while the cost of present and future debt has shot through the roof.

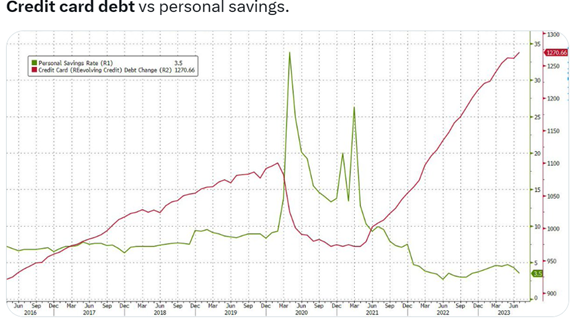

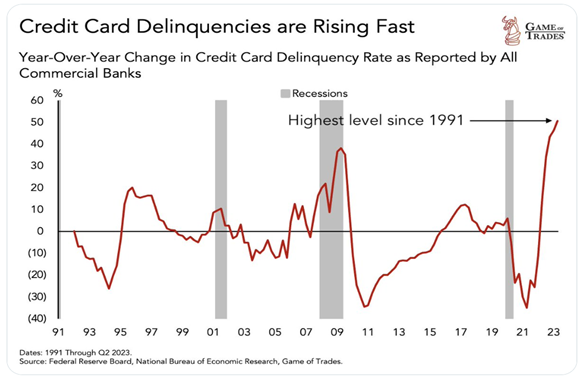

Credit Card debt is the highest since 2016 while personal savings have seen their steepest decline and are at a life low. 60 % of all Credit Card debt is now in trouble. Credit Card debt is the highest since 1991 and rising. CC debt is the worst form of debt and banks have the freedom to charge and revise the interest rates at their discretion. The stress that nearly 29% rate has caused (watch video) is unfathomable.

A large proportion of citizens just don’t have the money to repay the CC debt that’s nearing $1.3 Trillion mark. That’s 1300 Billion.

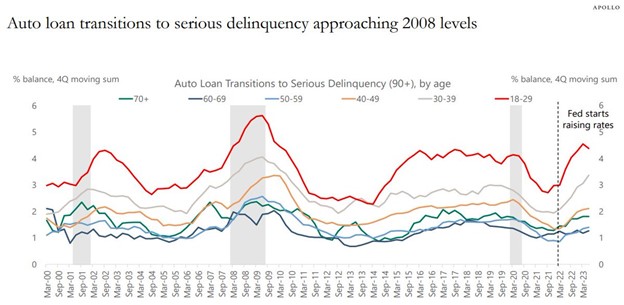

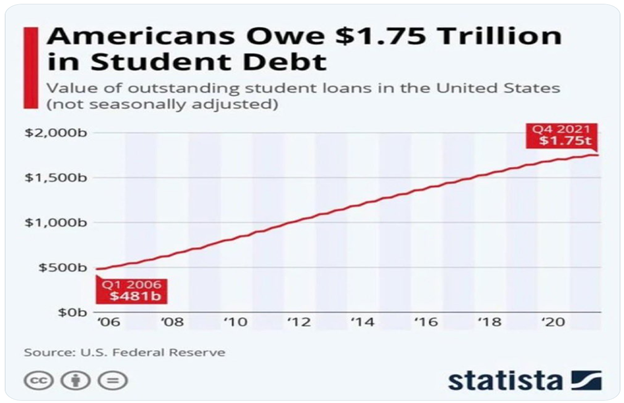

The auto loan delinquencies and the size of the student loan book is a telling story, The everything bubble will need a reset and that will be painful for one and all. Moody’s estimates the auto loan delinquency to hit 10% from its present 7.5 in less than a year.

What happens to nations that have sticky high inflation, declining populations, are engaged in constant conflicts (in land or outside) have borrowed colossal debt (more than the rest of the world combined) from the rest of the world and the lenders start to lose the confidence in the borrower’s ability to repay.

So the big question is – How does Mr. Buffett bet on America when he believes that ‘debt is death’. And for how long can Americans continue to comfort themselves with the belief that the USA is the greatest nation on this planet and it will figure it out somehow?

Is it some form of the redo of the Weimar Republic and the subsequent collapse of its currency? Whether the eventual bankruptcy happens now, in a few qtrs, or in a few years (as the US has this innate ability to keep kicking the can down the road) – but the bursting of the bubble, subsequent pain, and the reset, is inevitable.

A financial Armageddon in the coming quarters/years might be an understatement.

Conclusion: Whenever the bubble bursts, asset prices will see a deflation like never before wiping out decades of wealth creation and will be a permanent pivot in USA’s hegemony

- The insatiable desire to be the global policeman

When I wrote this piece “How USA can trigger a decade-long economic winter” in April of 2023, December seemed too far away symbolically and the worst fears have come true that USA will trigger, catalyze and accentuate a global conflict and will continue to make severe foreign policy mistakes while nursing its desperation to remain relevant.

Vietnam, Iraq, Afghanistan, Ukraine and now Middle East – One mistake after another, funding conflicts whilst your own country is passing laws to protect arsonists and thieves, is unable to do anything about gun laws as thousands lose their lives to brutal and senseless shootings each year, is figuring out medical and home expenses of illegal immigrants but was unwilling to afford evacuation of its citizens from Israel and was asking its citizens to pay for their evacuation from the war-torn areas.

US has bullied too many global players for too long with its divisiveness and formulating policies that only served its self-interest. Now, the facade of unity has crumbled, revealing the naked truth of a nation once draped in diplomatic finesse but now laid bare in the harsh light of global scrutiny.

Whatever you do – never wear the Emperor’s new clothes – For when your new clothes start getting called out – you stand naked – starkly naked for everyone to see.

This addiction with global policing has already cost the US terribly – and is only likely to exacerbate further.

If the world is a big family then the nation that assumes the seniority must let go to maintain balance. Consistently working for self-interest and achieving its goals through hook or crook at the cost of all others isn’t the making of a great nation that assumes global leadership. And the worst is – when others begin to realize this, the pretense of supremacy stands exposed. Its really a shame that US’s allies are allying with nations that aren’t yet truly mature to take on the mantle of global leadership.

The Big–Bully is now being bullied by the bullied.

Conclusion: Absolute self-interest (selfishness) at the cost of even the known allies has got US more enemies than it ever imagined and the confusion caused by rotating loyalties and alliances will create degrees of unrest that the world isn’t ready for – at this instance in time.

- Wokeism

I still don’t truly understand wokeism, its origins, or its true meaning. But I assume it must be some connotation of wakeism – the state of being awake – is it??.

In 90’s when we were reading at school, we used to read Romeo and Juliet, Charles Dickens, Ayn Rand and Toffler. Stories and lessons that are still relevant today. Toffler and Rand must be glad to be not alive in the present times to see the present-day priorities. Wokeism??? Are you serious???

When the world is grappling with an existential crisis, the top priority of the global elites and the present dispensation is to discuss climate change while creating a traffic jam with private aircrafts at Basel rather than actually doing something about it.

Making the ‘third’ toilet seems to be the top priority of the present dispensation and not saving one’s country from an imminent financial collapse and withering away the hard work of generations that made America Great at one point in time.

There is nothing wrong with Civil liberties and new connotations of civil liberties, but taking everything to an extreme while ignoring the most pressing priorities is a reflection of empires that are declining, where societal fabric is fragile enough (because of a failing state) to spark a revolution, if wokeism isn’t made a national priority.

Primary priorities can have addendums in advanced societies. Addendums can’t become the primary priorities while the former is completely forgotten.

When large swathes of population become dependent on the state and start basking in their mediocrity, the overall standard of the nation plummets in all walks of life. What else explains the fact that Indian and Chinese (basically immigrants) kids are acing Math and English while the teachers in the US schools are spending disproportionate time teaching over a dozen pronouns (the new priority) to the new America.

While, a large proportion of the population replies – “He is retired” when asked, – “Where is Jordan?”.

Wokeism can be an awakening not the only priority of a nation.

Conclusion: When nations become over-comfortable (through edifices of everything built on the unsustainable debt) the priorities become misplaced at a broad level and the overall fabric weakens, leading to a weaker nation. That’s what has happened to the US presently. As Michael Hopf quipped – Hard times create strong men, strong men create good times, good times create weak men, and weak men create hard times

- Appeasement Policy

The foundation of great nations is built on tenets of democracy, freedom of speech, and expression. These tenets allow the greatest minds to converge and get attracted to a nation and that’s how US of A was built. The land of immigrants who could shape the strength and destiny of a nation.

The immigrant diaspora is now leading some of the most coveted state and corporate positions. The US education system was neutral to religion or color and only underpinned in competence. Today – a tectonic shift has been orchestrated where a handful of people (because of their beliefs – and furthered by the misplaced connotations of civil liberties) can hold a nation hostage. And the state complies and relents.

Loot a store upto $950 and you won’t be considered a criminal and would be let go. How foolish I felt letting go that $900 jacket at Nordstrom because I loved it but didn’t feel like splurging so much on, if only I just had better cognizance of the law (humor alert).

Millions of illegal immigrants just walk into the country and are then provided hotels that cost the country hundreds of millions. If this money was to be spent from earned revenues anyone would think twice. But the FED’s printing machine couldn’t care less. But at some point, it will be too late. Or is it already.

The wall that Trump built at a cost of tens of billions of dollars was quietly sold off by the present dispensation for a mere few million dollars only to realize the folly and it is believed that Biden is planning to construct the same thing all over again.

Conclusion: Misplaced priorities, Short-termism, lack of cooperation between the two parties that continue to ignore the common compelling goals of a nation – is what defines that is left of – the once formidable US of A and what it stood for.

- Allowing the world to have an actual read on your intentions

The most important rule of poker is – whatever you do – don’t allow anyone to have a read on you. You let your read-guard down and you are done. You simply lose. That’s where US is right now.

America was always known to have a strong set of friends and enemies and all its allies foolishly thought that US will go all out to stand by its commitment and honor till the time they realized that US was just an opportunist in the vast ocean of geopolitical conflicts. From Pakistan being an oppressed cousin (in olden times) to being a perpetrator of terrorism. China being the hottest destination for US investment to it being vilified for all kinds of wrongdoings now. Losing the trust of Saudis despite Saudi being the most formidable erstwhile US ally.

You need oil – you attack Iraq on false narratives of WMD’s

You need conflict – You Orchestrate Ukraine.

You need to save the Treasuries – You create a conflict of regional proportion to break the (just beginning to form) alliance

The trouble/beauty is that everyone has got the read. Even Zelensky is now wondering – why didn’t he accept Putin’s terms that sounded reasonable in hindsight.

The day isn’t far that Zelensky will be having a drink with Putin. Because everyone is getting a read on the US’s hand.

Conclusion: Surviving on the bedrock of global conflict cannot ever be a sustainable political strategy. It is questionable short-termism that has long term negative ramifications. And US has landed itself in a tight spot of bother with the entire world having a read on its intentions.

- Loss of confidence in US treasuries

As I had written in my piece a few months ago, the biggest mistake US committed in the recent past was sanctioning the $650B of Russian foreign reserves. Let’s park aside for a moment, whether Russia was right or wrong in its action on Ukraine. A currency that was made to believe to the world – to be stronger than gold and more reliable and transactional than gold, cannot be rendered useless on the whims and fancies of a political leader, or the philosophy of a nation that’s consistently been proved wrong over the last few decades. That country is definitely in trouble because none of its policies are reliable and global enough to remain non-aligned to the perception of the powers that be.

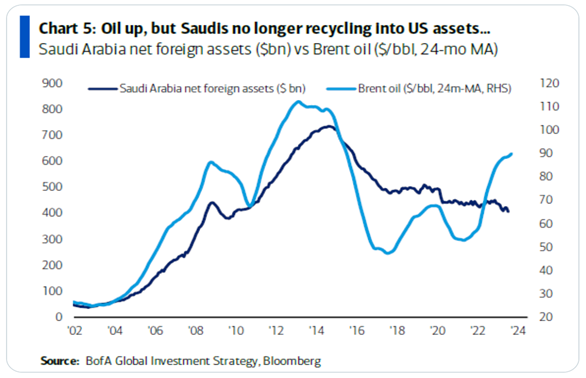

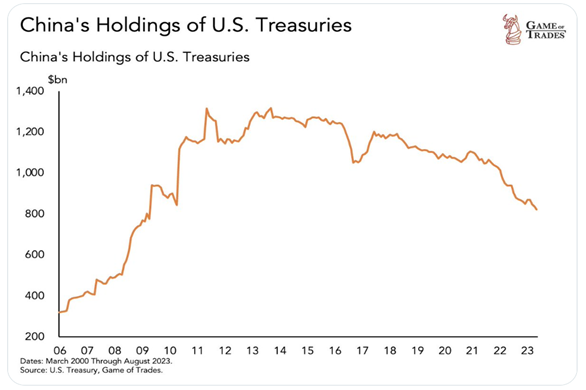

China and Saudi are selling US treasuries at a rate faster than one can possibly fathom. Because most of the rich nations have realized that they bought dollar-denominated assets at the cost of the strength of their own currencies. Having realized that dollar-denominated assets (read treasuries) are just fugazi, China, Saudi, India and so many other nations are getting rid of a large UST portfolio and thereby protecting their own currencies.

Saudi’s holding of US treasuries is down 40% from Feb 2020 levels. This is despite crude prices moving up. This money might be getting into Emerging markets assets (primarily India) and the most historically reliable asset – Gold.

But the bottom line is – If you can block/sanction my assets after selling me those assets – I will do whatever it takes to get rid of those assets and buy something that’s globally acceptable – GOLD

And that’s why all Central Bankers – Singapore, Poland, China, India and Brazil are buying gold at an ever-increasing pace. What are they seeing that the common man isn’t?

Conclusion: The world’s safest perceived asset – the US treasuries do not enjoy the same status anymore and nations that happily funded the US debt for decades are beginning to rethink the sustainability of this mountain of debt. If today, top 2-3 funders of US debt decide to do a firesale (and that possibility is slowly becoming a stark reality) it will create ripples that will take decades to settle and by that time it will be too late.

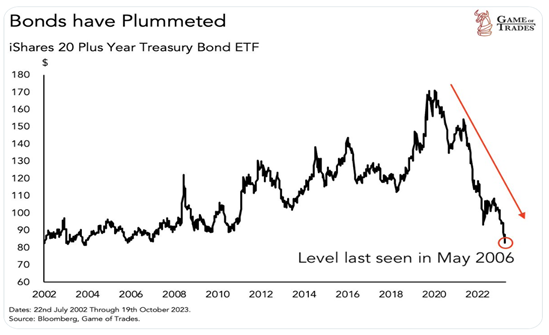

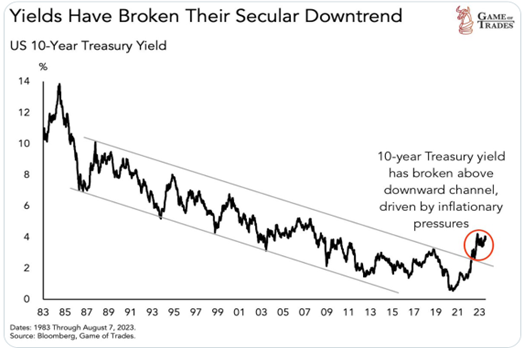

This sharpest drawdown in Treasury bonds has led the 20-year Treasury bond ETFs to its lowest level since May 2006 – a nearly 50% collapse.

I repeat – a nearly 50% collapse in the most reliable financial instrument on earth.

The price of treasuries falls when yields rise (inversely proportional). For every 1% rise in yields, treasuries fall by approx. 7-8% so when interest rates rise by 1900% and go from 0.25% to 5.25%, the treasuries fall by approx. 40-50%.

But the fall in treasuries also happens when there is no taker for it and the seller is ready to take a loss on its holding as it is expecting that US treasuries could fall a lot more and the yields could rise a lot more. Junk bonds (high probability of default) used to have these kinds of yields just a few qtrs. ago.

Almost every American running towards high-yielding US treasuries, earning nearly 5-5.25% yields, must also remember that if interest rates were to go up a bit say another 1%, the bonds would lose their value by another 7-8% and the capital and return on investment will be retrievable only at the end of the term. And if US defaults on its debt along the way – which is likely to happen at some point in time – the average Joe could lose one’s entire investment.

Obviously, it’s an outlier scenario but possible nevertheless.

Investment in T-Bills yielding close to 5.5% in short-term bills seems to be the go-to trade for a large spectrum of people who haven’t seen these rates in a generation. But while the erstwhile buyers of American treasuries (Japan, China, Saudi, and others) are selling their holdings at the fastest pace in 40 years, the Americans are increasing their share in these holdings rapidly.

This simply implies that the local investors are giving an exit to the foreign countries that are losing faith in the US debt and dollar-denominated assets.

Each time the US raises its debt ceiling – the markets rejoice and so do the politicians. Whereas any prudent person should be very very worried with this ever-burgeoning pile of unserviceable debt. The probability of the US default is highest ever and retiring old debt by new more expensive debt time and again – we all know how it ends.

Conclusion: Black Swans are called so because they can’t be predicted and these events almost always seem impossible till they aren’t.

- The Home buying conundrum

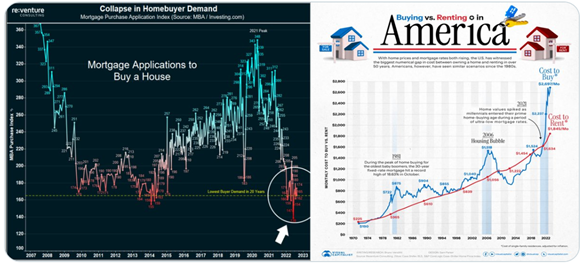

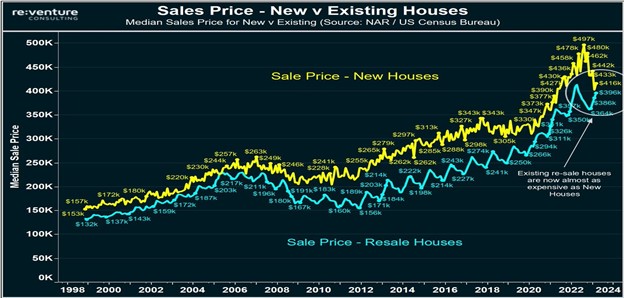

The median home prices (single-family homes) in the US are up 3% from a year ago. And just as the mortgage rates have hit nearly 8% for a 30 Y loan, the existing homeowners are happy because they have locked in their mortgages at less than 3% for 30 years and a lower cost of capital discounts the asset prices at a much higher level and the new potential buyer can only buy a home at a much lower cost to be able to afford the mortgage.

So in effect, all it would take is one transaction at a lower cost to start a downward spiral of home prices just like the 2008 collapse.

Mortgage applications are at multi-year lows and the cost to buy a house has accelerated steeply and is much higher than the cost to rent. Higher US interest rates are the main reason while banks have also tightened the lending standards post Sub-prime crisis in 2007/08.

Existing home prices have just surpassed the new home prices due to higher demand for the former. No one wants to sell their old house with old mortgage rates of 3%, whereas the new home financing will come at a much higher mortgage rate and so seeing less demand.

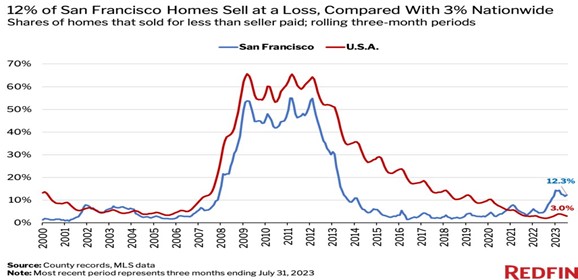

1 year ago, 5% of all homes in San Francisco were sold at a loss; the same now is at 12.3%; higher than the national average of 3%.

Conclusion: Homes are the most significant investment and the most important asset in everyone’s life. If 2008 and subsequent years were painful, imagine what it would be like if the house prices were to correct a lot more and stay there a lot longer.

- The common man’s problems: US Inflation, Real Wages growth

US inflation

Inflation numbers that were out for Nov’23 softened to 3.1% YoY due to lower Gasoline prices. But the core CPI (which excludes energy and food) was sticky at 4% and saw some acceleration MoM. This makes any imminent easing by FED questionable. – If taming inflation is really the priority.

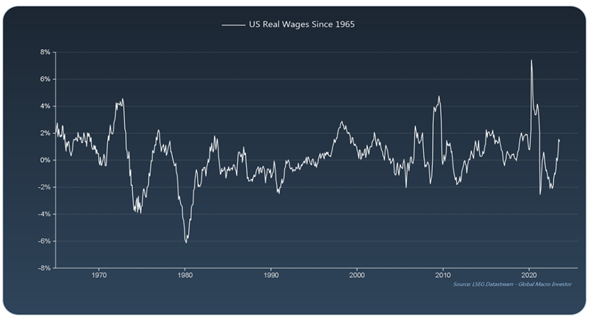

US growth in real wages at 2% is at 1965 levels. This amplifies the impact of any asset growth on consumption trends

US Retail sales MoM %

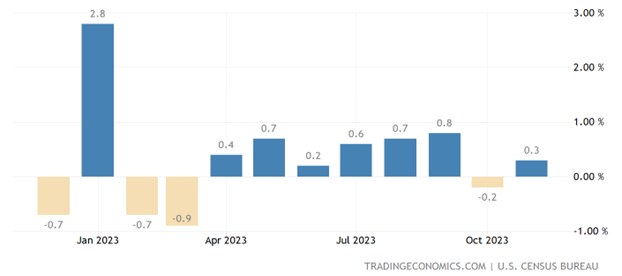

Retail sales growth softened in the last 2 months after 6 months of uptrend. The Nov data was positive on account of the holiday shopping season in the month and driven mostly by sales at food services and drinking places.

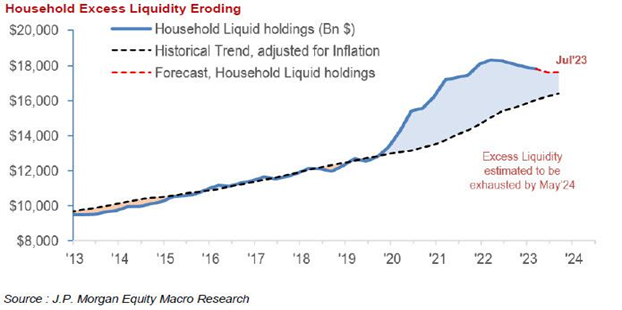

Excess household savings in the US which were built up during Covid periods are fast depleting at 100bn$ per month and will completely get depleted by May 2024. This is why household debt levels are skyrocketing.

Conclusion: Hundreds of billions of $ were just printed from thin air and distributed after March 2020 which fuelled the inflation and false sense of “all is well” with US economy. The robust consumer spending and low unemployment numbers weren’t because of a vibrant economy producing higher actual goods and services. It was debt. And that’s now nearly finished at the hands of citizens. The soft landing will be as soft as inflation was transitory. The M2 money supply is the lowest in decades. It won’t be a soft landing. It will be the hardest that anyone has seen or experienced.

- De Dollarization and Losing control over financial network

De-dollarization sounded just a figment of imagination till a while ago till it started becoming a reality

Dollar-denominated trade flows across the world, and the US bank-dominated SWIFT system of currency transfers gave the US an edge (USD has 43% share in international money transfers across the World) in controlling the trade and hence it was easy to sanction any country that didn’t conform to its hedonistic tactics – but the new powers that be are slowly rejecting this system as explained by ever-increasing request for BRICS membership.

This has now resulted in more bilateral trade agreements in local currencies circumventing the Dollar and US banking networks and probably making the SWIFT and the Dollar irrelevant in the not-so-distant future.

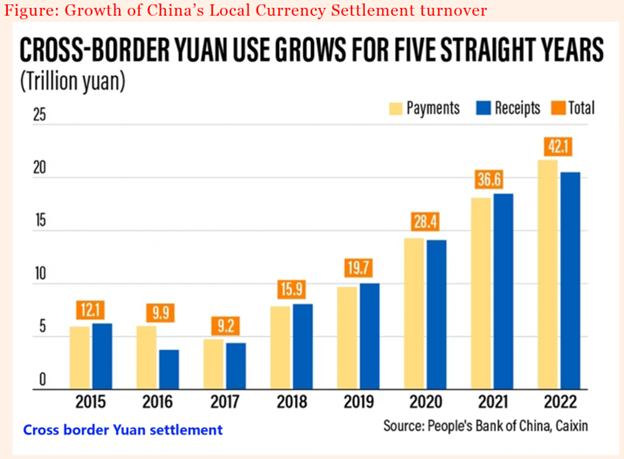

China’s cross-border trade settlements in Yuan have increased 3.5x from 2015 till 2022. Renminbi’s share in global money transfers is still under 3% but the rapid acceptance in the past few years is something that USD should watch out for.

Conclusion: De-dollarization is being scoffed at by the global elitists and everyone is suffering from anchoring bias. While the other formidable nations are effectively bypassing the dollar. The demise of the petrodollar is a matter of when – not if. And this could lead to a sharp downward revaluation of the dollar and dollar-denominated assets (US housing, Stocks, Savings, 401(k)s) one sudden morning.

- Demographics and the wealth generators

America was once a nation – That exclusive land of opportunity, that could attract the best talent and retain it. It was the nucleus of global inventions and a beacon of prosperity. Today, however, that gleaming promise has dulled, the allure of opportunity has faded, and the once bright nucleus of innovation is clouded by divisions and challenges. The symphony of progress now echoes with dissonance, as economic inequality and social discord drown out the harmonious chords of unity. The American dream, once a vibrant melody, now plays against the backdrop of skepticism and uncertainty, challenging the very essence of what the nation aspired to be.

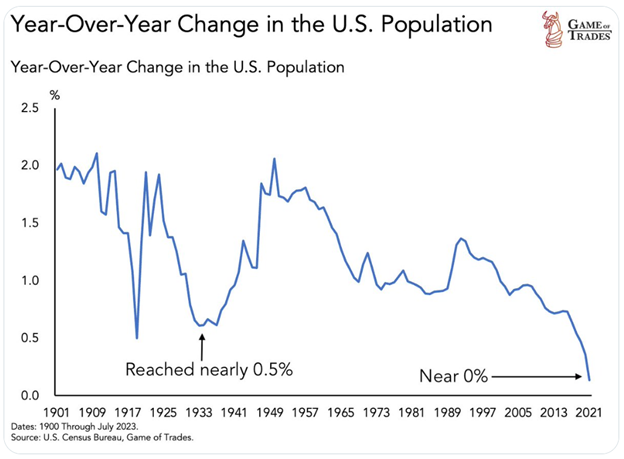

US population is now stagnating; 0% growth for the first time in 100 years. For US consumerism which has driven exports growth for many countries including China and India, this is bad news. The big spending habits of Americans is not going away but the likely fall in the numbers can stun growth which has been feeding many economies so far.

The greatest-ever Roman empire perished because their growth rates dwindled.

Perhaps Biden needs to do a Kim Jong Un to appeal to the Americans to start making babies

US has been the most innovative country in the World and the free-spirited thinking has given birth to many Unicorns and companies with cutting-edge technologies and inventions that have created and distributed enormous wealth. It was well-debated why the UK or any other prosperous European country wasn’t able to create a Facebook or Google.

The answer might lie in the independent and free-spirited US mind in its T-shirts and Boxers that can think out of the box than a British who get themselves boxed in well-ironed Tuxedos. Americans till date have always found new ideas to generate wealth and has wowed the world. The recent concerts by Taylor Swift has boosted the US economy to an extent that Fed thought it imperative to mention the same in its monetary policy report. Though this is miniscule as a percentage of US GDP, the ability of a pop icon to generate such interest and money is commendable.

But all this could be the things of the past if US doesn’t replicate its past successes by getting its priorities right.

The right priority is all that matters.

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” – Charles Darwin

The Great Emerging Market Opportunity

Everyone likes an Underdog to win and India today is that glimmer of hope and promise whose time has come. As the World today comfortably likes to hate China for various reasons (Covid, Currency and Communism) and looking for China + 1 strategy India seems to be the only obvious and viable choice.

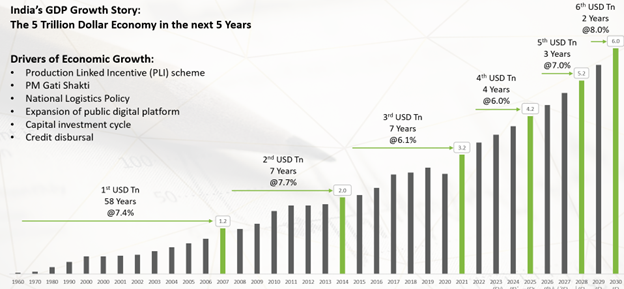

At nearly 8% growth and a well-managed inflation (thanks to the most respected India’s Central Banker who has been adjudged the best among all his global peers) India is just the obvious choice and any manager (corporate or fund) really doesn’t have a choice but to allocate a respectable quantum of resource under his discretion to India.

- GDP: India stands tallest among other developed and developing economies in terms of GDP growth rate

At nearly 8% per annum, India will double its GDP every 9 years.

- Burgeoning and vibrant stock market (driven by Indian retail money offsetting the outgoing FII and FPI money)

Indian stock market – despite its small 4 Tr $ MCap – is attracting more than 3 Billion USD each month just through domestic SIPs (Systematic Investment Plans) of Mutual Funds. And this is just the dormant passive investment – that keeps getting invested month on month by default. Add to it the Foreign investments by global Sovereign and Pension funds, the rise of Sensex from 45000 to 70000 in just 3 years speaks volumes of India’s corporate growth story.

Anyone not having or thinking about a significant India allocation is doing oneself a grave injustice to one’s future generations even as this opportunity is efficiently and easily available to the NRI/PIO community.

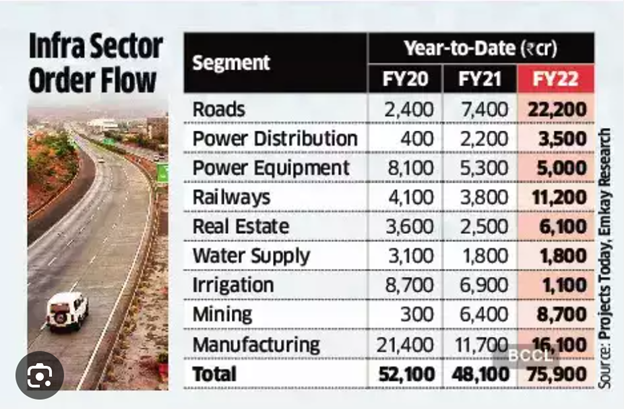

- The fastest and largest growth in infrastructure

While the infrastructure is crumbling in the developed nations (as fighting wars seems to be a more pressing need than investing in infra upgrades – amongst the Western nations), India is making freeways at the fastest-ever speed and size. A recent record that made itself into the Guinness Book was the construction and commissioning of 75 kms of Freeway in a matter of 105 hrs.

Nations that continuously invest in infrastructure have superior growth in quality of life and quantum of economic activity and India now is racing ahead in terms of infrastructure spending.

The investment in and the development of core infrastructure is the highest that has ever been in India. This is creating the fastest and the largest pool of middle-class and SMEs (Small and Medium Enterprises).

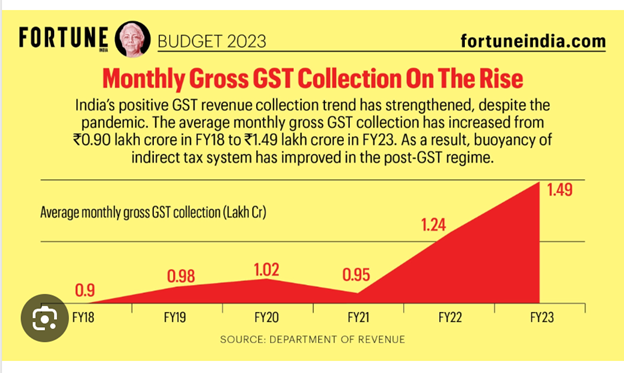

- Tax collections

The ever-increasing Income Tax collections and the GST (VAT equivalent) speak about the tens of millions of people’s contribution to growth and domestic consumption that has left even the policymakers surprised but obviously reflects the sentiment that India’s time has come. Optimal usage of technology to interlink bank transactions, credit card spends, and investments with tax filings have increased tax compliance; the number of income tax returns filed has doubled in the last ten years.

This data is in sharp contrast to California (The most prosperous US State and 4th largest economy in the world – If CA was an independent country) where tax collections are sharply lower and declining compared to the spending thereby pushing up the fiscal deficit. – A reflection of dwindling individual incomes.

- Industrialization

The Production Linked Incentive (PLI) scheme where Govt incentivizes domestic production and export of Goods has been a game changer to the manufacturing activity in the country. Manufacturing growth has outpaced growth from other sectors in the Indian Industrial Production (IIP) index in the last few quarters and one of the reasons is the PLI scheme. India has been late in catching the manufacturing bus but the China + 1 strategies of the developed nations have given an opportunity and India has grabbed the same.

Apple currently produces 10% of its Iphone in India and wishes to take it to 20% by 2025.

- Automobile growth and demand (long waits to get a car delivery)

India’s automobile sector has left the Korean chip makers baffled. They just can’t keep up with the demand of the sector which has grown 20% YoY in the last year. The annual sale of 24million 2-wheelers and 6million 4-wheelers and Commercial vehicles has led to long wait times just to buy a vehicle

It took me 14 months to get a simple car recently after having booked it in Sep of 2022. That’s the demand and supply mismatch and a reflection of the growth that the Indian automobile sector promises.

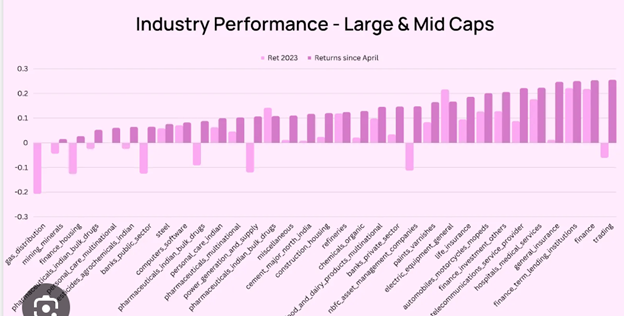

- The secularity (breadth and depth) of investment options in India

If the magnificent 7 stocks in the US (AAPL, GOOGL, MSFT, AMZN, META, TSLA, NVDA) were not trading 3 STD deviations more than their mean (depicting extreme overvaluation), The US markets S&P 500 and Nasdaq would have been flat for the year, as compared to 20% and 38% returns in 2023 respectively

Obviously, this party will end and once the money (that was printed and distributed freely during COVID) runs out and the downward spiral starts, US stocks could redo the 1929 bear market. It took nearly 25 years for the indices to get back to the pre-crash levels of 1929. And the size of the problem in the US presently is a lot larger than it was in 1929.

In contrast to that, the Indian markets offer a better spectrum of choices with a breadth better than any other country other than the US

Source: Smallcase

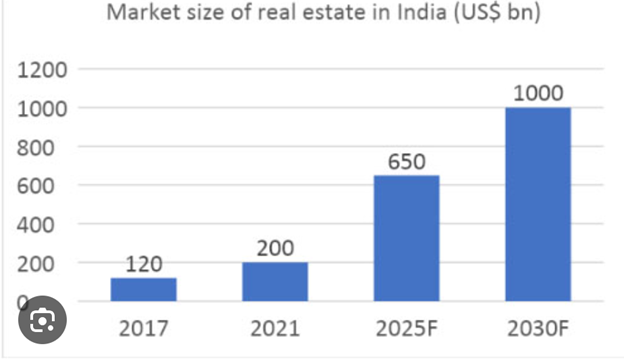

- The Real Estate market

DLF, a Gurgaon-based real estate developer sold nearly 1100 apartments in 3 days with an average ticket size of 1 Million $ and each time it launches a project the mile-long queues to book these, pale the ones that get formed before Apple stores on the launch of a new iPhone across the world. And we are talking of super expensive luxury homes and not an 800$ iPhone.

Source: Avalon Global Research

- The new “Land of Opportunity”

I happen to live in a community where nearly 50% of the residents are expats and as I enjoy my Sunday tipple with one or another chatting about the India growth story and its global perception, I hear that an India stint has become a necessity on one’s Resume and is no longer a choice for all global executives who are hungry and ambitious.

The largest market for services and goods and the most resilient and ambitious population makes India the land of opportunity that the US was in the 70’s.

- Political stability

The global appeal of our Prime Minister Modi (reflected through the Leaders of the so-called first world nations lining up to take selfies with our PM at global summits) and his ability to sweep through elections, term after term and year after year and demonstrate the concept of pro incumbency as a result of corruption free leadership and inclusive growth has cemented his Prime Ministership for a minimum of next 2 terms. The sense of political stability backed by proven statistical growth numbers makes it imperative to go all-in on India.

The Way Forward:

The present moment demands a profound awakening among the global Indian Community imploring them to recognise that allocating a substantial portion of their wealth within the boundaries of India transcends the conventional notion of diversification – it is, in fact, a strategic move to shield against the impending implosion of the United States’s economic edifice.

As the pillars of the US empire begin to look vulnerable, and the state of the economy stands at a point of no return, it is a poignant imperative for the Indian Diaspora to avoid the potential tragedy of forfeiting a significant portion of their fortunes. Such an outcome could materialise not only due to an inevitability dictated by economic forces, but also as a consequence of anchoring bias and a reluctance to confront the harsh realities that stand ominously before them.

Manu is the Founder and CEO of MRG Capital – A SEBI registered Wealth Management and Portfolio Management Services Provider. He is a MBA graduate from Warwick Business School and opines on a broad spectrum of subjects on his blog – www.manurishiguptha.com. You can also follow him on Twitter @ https://twitter.com/manurishiguptha

____________________

Credits for graphs and data:

@GameofTrades

@KobeissiLetter

@zerohedge

tradingeconomics.com