Disclaimer : I only know of Vijay Mallaya thru information available in public domain. I feel sorry for the few of his

employees (who had to take their lives in distress) and their families.

employees (who had to take their lives in distress) and their families.

I have come across more than a few people who used to tell

me with an accent, pseudo enough, that they only flew kingfisher

and took pride in it. The parties that Mallaya threw and the host that he was, made national news and was hot topic among the socialites during the man’s good times.

me with an accent, pseudo enough, that they only flew kingfisher

and took pride in it. The parties that Mallaya threw and the host that he was, made national news and was hot topic among the socialites during the man’s good times.

All his alleged friends turned critics who have now

All his alleged friends turned critics who have nowdenounced him and written him off – I personally feel, have neither been his

friends, nor ever accompanied him to the shoot of the famous kingfisher

calendar and maybe due to that have felt jealous enough to see him wrapped by

young damsels – perhaps often a third his age.

His nemesis was his blatant show of his hobbies even during

the times that were bad for the king of good times.

the times that were bad for the king of good times.

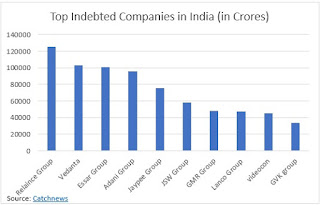

But lets get the record straight. We know that he owes some

1 billion USD approx. 6000 to 7000 INR Crores to the banks, and the banks

are claiming some 1.3 Billion USD as

recovery of dues including

interest. That he left the country in a hush was definitely wrong, perhaps his

own interest in General Knowledge was poor for he was a small ignorable fish in

the pecking order of defaulters even on the day he fled India.

1 billion USD approx. 6000 to 7000 INR Crores to the banks, and the banks

are claiming some 1.3 Billion USD as

recovery of dues including

interest. That he left the country in a hush was definitely wrong, perhaps his

own interest in General Knowledge was poor for he was a small ignorable fish in

the pecking order of defaulters even on the day he fled India.

But what a shame on the fugazi of a system of political patronage

in India that a well meaning entrepreneur cannot fail and irrespective of all

past successes one failed business decision brings down the edifices of success

and remarkable history.

in India that a well meaning entrepreneur cannot fail and irrespective of all

past successes one failed business decision brings down the edifices of success

and remarkable history.

Just imagine that Indian banks are happily

taking haircuts under the aegis of the government and are made

to own 51% of Jet airways and I fail to understand why Jet wasn’t

meted the same treatment as Kingfisher.

taking haircuts under the aegis of the government and are made

to own 51% of Jet airways and I fail to understand why Jet wasn’t

meted the same treatment as Kingfisher.

If the promoters of top defaulting companies and siphoning

If the promoters of top defaulting companies and siphoningagents of this country can still continue to thrive and enjoy and use the

sloppiness of our legal system to wade their way through and still lead

luxurious lives – something in this nation isn’t right while the financial

systems and institutions of this nation are on their knees.

Essar has made a mockery of the system by trying

to skittle the NCLT process by throwing in financial googlies without

any locus standi. If they actually had the monies to clear off their debts, why

did they default in the first place. Shouldn’t just this statement be enough to

punish them for their deeds or intentions?

to skittle the NCLT process by throwing in financial googlies without

any locus standi. If they actually had the monies to clear off their debts, why

did they default in the first place. Shouldn’t just this statement be enough to

punish them for their deeds or intentions?

And yet we cant stop vilifying Mallya who was driven to elope

inspite of making infinite efforts to keep his airline afloat, to make an

effort after effort to persuade the government to change policies to make

airline business viable, to believe in his conviction to run a world class

airline and giving personal guarantees to raise debt for his beliefs.

inspite of making infinite efforts to keep his airline afloat, to make an

effort after effort to persuade the government to change policies to make

airline business viable, to believe in his conviction to run a world class

airline and giving personal guarantees to raise debt for his beliefs.

Different strokes for different folks – is what the broken

political value system of this country stands for. Crony Capitalism, Promoter

Banker nexus (a’la ICICIdeocon) must have shaved a percentage points off our

GDP.

political value system of this country stands for. Crony Capitalism, Promoter

Banker nexus (a’la ICICIdeocon) must have shaved a percentage points off our

GDP.

If Mallaya is to be made a global spectacle of bringing a

defaulter back and hung out to dry, shouldn’t our government or the powers that

be, be putting atleast 5 dozen top defaulters behind bars and setting an

example immediately. Mallaya’s debt seems like a small speck in the ocean of

frauds and delinquencies in the Indian Banking space.

defaulter back and hung out to dry, shouldn’t our government or the powers that

be, be putting atleast 5 dozen top defaulters behind bars and setting an

example immediately. Mallaya’s debt seems like a small speck in the ocean of

frauds and delinquencies in the Indian Banking space.

And yet big defence contracts worth tens of billions of

dollars are being doled out to the very people or their companies who are not

in a position to pay a couple of million dollars to their vendors in other

businesses and are declaring bankruptcies. Isnt this a sham of gargantuan

proportion.

dollars are being doled out to the very people or their companies who are not

in a position to pay a couple of million dollars to their vendors in other

businesses and are declaring bankruptcies. Isnt this a sham of gargantuan

proportion.

It would be interesting to watch how the top indebted

It would be interesting to watch how the top indebtedcompanies fare over the next decade as it is quite possible that most of these

are hiding behind the fine art of evergreening their debt. Uday

Kotak mentioned in his article of June 2018 that the NPAs of Indian banks

could well be over 150 billion USD and we all know that the real number could

be much much higher.

Give it to the Mallaya – atleast for academic interest –

that :

that :

He brought order to Indian liquor industry and created the

worlds largest liquor company (by cases)

worlds largest liquor company (by cases)

Took on some of the biggest global brands and had the

audacity to buy some top liquor brands globally.

audacity to buy some top liquor brands globally.

It would be worthwhile to calculate the downstream taxes

paid by United Spirits and United Breweries over the last five decades.

paid by United Spirits and United Breweries over the last five decades.

Hubris makes people do wrong things at wrong times and

Mallaya was wrong to have called Enrique for his 60th while his

employees were suffering for non-payment of salaries. He should have kept a low

profile while his troubles were surmounting and demonstrated remorse and an

intent to resolve.

Mallaya was wrong to have called Enrique for his 60th while his

employees were suffering for non-payment of salaries. He should have kept a low

profile while his troubles were surmounting and demonstrated remorse and an

intent to resolve.

And fear after hubris made him to run away for he was

riding a tiger from which, he couldn’t get off.

riding a tiger from which, he couldn’t get off.

I think more than a few times Mallaya has offered to pay

the entire principle back to the banks if he is given time to resolve. On the

one hand the financial and administrative machinery of this nation is taking haircuts

on delinquent loans to the extent of 30-50 billion dollars and on the other it

is hesitant to allow a guy to make an amend to the only mistake he made in his

life – of founding an airline.

the entire principle back to the banks if he is given time to resolve. On the

one hand the financial and administrative machinery of this nation is taking haircuts

on delinquent loans to the extent of 30-50 billion dollars and on the other it

is hesitant to allow a guy to make an amend to the only mistake he made in his

life – of founding an airline.

For Mallaya – Come back, satiate the ego of the government

by going behind the bars for some time and take control of your businesses and

assets and genuinely say sorry to your ex-employees. You can still bounce back

as you are in a business that never suffers from an economic cycle or a

recession.

by going behind the bars for some time and take control of your businesses and

assets and genuinely say sorry to your ex-employees. You can still bounce back

as you are in a business that never suffers from an economic cycle or a

recession.

For Govt – Have a fair policy that’s similar for everyone,

allow this man to set his business straight, leave an impression that its

perfectly fine for an entrepreneur to fail and restart. By sending that

message, you would have set an example for an ocean of entrepreneurs, some of

who fail and want to succeed and keep trying.

allow this man to set his business straight, leave an impression that its

perfectly fine for an entrepreneur to fail and restart. By sending that

message, you would have set an example for an ocean of entrepreneurs, some of

who fail and want to succeed and keep trying.

Because say what you may – Mallaya was the ‘king of good times once upon a time’.

Manu also writes in the Huffington Post

Follow on twitter @manurishiguptha

Absolutely right! Very aptly put.

Good one Manu……this one view I have held for a long time. And, true, he has offered to pay back the principal and more, more than once

He is being made the poster boy of defaulters.

All it takes is a check to see who owes the banks how much, irrespective of whether NPA or not.

If it's not NPA today, that can be tomorrow.

When the time was ripe the govt of the day distributed loans, now when it's not as good, we are not allowing the biz to pay back.

Pull the carpet from under them and make a scene.

Well said Manu.Mallya deserves to get a proper settlement hearing from the government.

Very true

Yes , U are Right , Good Session for all entrepreneur ,Govt, and Banks , We can't blame Him 100 % , We are living current system its take time to change. and Let him come back and Prove himself as king of Good Times

Greetings! Verry useful advice in this particular

article! It's the little changes that make the largest changes.

Thanks for sharing!

As obvious as the sunrise, only succinctly narrated. Had he chosen to exhibit a tad more grace in his general conduct, he may have actually been an inspiration for atleast 2 generations !!

Sadly now, what is, is. And the rest is history. ��

As obvious as the sunrise, only succinctly narrated. Had he chosen to exhibit a tad more grace in his general conduct, he may have actually been an inspiration for atleast 2 generations !!

Sadly now, what is, is. And the rest is history. 😅

V well analysed.. so typical of this system … yes what about others ? And so many more like mallyas who r enjoying the banks money

Hello, yes this paragraph is genuinely fastidious and I have learned lot of things from it on the topic of blogging.

thanks.

Lovely analysis

VIJAY MALLYA IS KING OF GOOD TIMES. TIMES CHANGE. LONG LIVE THE KING.