Warren

Buffett’s seemingly most popular quote “Price is what You pay and Value is what

You get” doesn’t seem more destroyed or intrigues the patron more, when one

pays ~Rs300 / USD 4.5 for a 100 gms box of popcorn at an Indian multiplex, whereas in India 700 million people earn less than Rs 100 per day or say ~USD1.4 / day

But this

piece isn’t about the Indian Economy, its about the market darling – PVR

Cinemas.

place a disclaimer right here – I love PVR Cinemas, I along-with my wife and mother

almost never miss a movie at PVR and she loves the popcorn – being from the old

school. If I were to tell her that the ticket costs 2000 Rs a piece in Gold with green

tea (that she loves) (a Twinnings tea bag worth Rs 3 dipped in hot water sold

at some 80 times the cost) she might have a heart attack. But this is a secret

between PVR and me. Mom never gets to know of it.

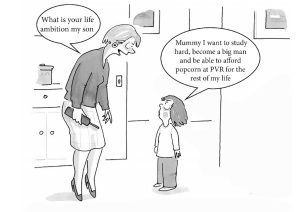

The purpose

of this piece is to inform the gullible minority shareholder that while all the

institutions are dumpin the favourite PVR stock, You are being made the muppets and when the

music stops, you will have nowhere to run. Its pertinent to

mention that the shareholding of people with less than 20,000 shares has

shot up from 3.5 – 10.5% in a matter of just 9 months.

the company that’s now more expensive than TESLA – already trading at

some 800 PE

PVR

generates an EBITDA of Rs 60 per patron / movie watcher

Sale of

F&B is Rs. 948crs or ~ 28.8% of total sales and 55% of Movie Sales Revenue

or Rs. 93/patron.

Cost of

F&B is 8% of sales thus 72.5% Profit Margin on Popcorn or say Rs. 67/Patron

comes from F&B

Which means

EBITDA Loss of Rs. 7/patron is generated by (Sale

of tickets + Advertisement Income + Convenience Fees + Other Operating Income)

the core business.

SO ITS SAFE TO ASSUME THAT PVR IS JUST A POPCORN AND A NACHOS COMPANY

I feel sorry

for the shareholders of the company that places its QIP at Rs 1719 and within a few

months has to come up with a rights issue at Rs 784 because the ever burgeoning debt, is unmanageable, future is uncertain and probably the promoters have to be paid arrears of their handsome

increments even while the wealth of minority shareholders is being blatantly

destroyed – some by pandemic – some by the promoters.

Here are the

statistics

As per the management,

in a recent concall in May, the breakeven of PVR is at at 20%

occupancy and Average Occ that PVR enjoyed is 35% in precovid times (And achieved

an 18% EBIDTA and 0.8% PAT margin), One question that comes to mind is – if

capacity utilisation in the best of the times is 35% generating such abysmally

low PAT, what effect will a lower occupancy have on the P&L and the Balance

Sheet

And the

EBIDTA sucks because the promoters who own a mere 18.79% of this company draw a

cumulative salary (besides all other perks and privileges) of ~ 28 Crores that

is slightly more than the PAT of the company. A back of the envelope calculation pegs the EPS for promoters and family at approx Rs 32 per share while its a paltry Rs 4.95 for other shareholders.

It’s a shame – more so in India – because stockmarkets are shallow, lack depth,

and most shareholders have no access to genuine research on the basic and key metrics

of the company, intention of the management, and self centricity of the

promoters at the cost of minority shareholders.

PVR has been incurring ~ monthly expenses of 63 Cr (assuming 50% waiver on rent and CAM charges) so if this year is more or less a washout, it would have burnt approx. 750 Cr without any mentionable revenue in FY 2021) And that explains the short runway of the amount of Rs 300 Cr collected thru the rights (in Aug 2020) that might not have lasted beyond 5 months.

“The business is

under a grave irreversible threat”

Ask a producer of a film and he/she is under permanent nervousness till one week

after release of his movie – not knowing whether one would be able to recover costs, make

profit or lose the skin.

The immense

sense of freedom that most of the producers such as Ronnie Lahiri have found by releasing

movies on OTT is

heartening. Gulabo Sitabo was a great hit, made him the money and de-risked his

investment. Top OTT players are happy to buy movies at a cost + basis, thereby

de-risking the producers and the OTT players such as STAR, Amazon, Netflix have

pockets tens of times deeper than the size of Indian film industry at ~13800 Cr

(1.8 B USD) where the Bollywood is a mere ~1000-2000 Cr per annum

For the

record Amazon and Flipkart burn a combined sum In

excess of Rs 1,500 crores just during their Diwali sale alone.

OTT is really the future because a family can watch a movie

in the convenience of ones Living room where the annual subscription of the

most expensive platform is less than the cost of “just one” movie with the family

at a multiplex. We haven’t yet discounted the pain of navigating the traffic,

parking, lack of social distancing, risk in the AC (after Corona) world where

the human psyche has got permanently mutated because of the present unexpected

vicissitudes. The brilliant analysis by Seetharaman

in The Ken sums up the dilemma and the zero

sum game for the cinema halls.

No wonder

that the sale

of large TVs and projectors that cost as little as Rs 10 K on amazon has shot

up in the recent times because of the newfound freedom by the movie buffs.

Low budget

films, some of these dramatically awesome

in content and direction, that cannot afford a big budget theatre release have

found a new freedom and recognition and have been able to shed the risk bias of

the patron because the incremental cost of watching this movie is almost nil

for a family (if at all the same turns out to be a dud or below expectations).

Not that the wounds inflicted on the populace by Salman Khans Tubelight

or Aamir Khans Thugs

of Hindostan can ever be healed. And

on top of that the Rs 300 popcorns.

OTT reduces/almost-eliminates

piracy and provides a reach to the most under provided sections of society

where access might be a problem, but internet works at a good speed.

The demise of Cineworld with 9500 screens was a shock that had to down its

shutters on almost 90% of its business due to the pandemic. And the hunger of

retail shareholders to lap up the PVR stock seems unsatiable.

If this

virus – that has permeated such degrees of fear in the society is here to stay

for a foreseeable future then the future of multiplexes is in grave danger and that

explains why the institutions or the big boys of the stock markets are strategically

reducing their stake while holding the price at present levels and retail

muppets (shareholders) are hungrily buying the stock to take the retail

shareholding up from 3.55% in Dec 2019 to 10.32% by Sep 2020.

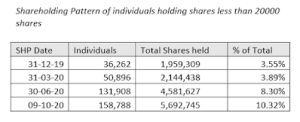

Unless

another equity infusion takes place, The PVR debt will continue to burgeon, for

many many years, to its peak of approx. 2100 Cr by Mar 2022.

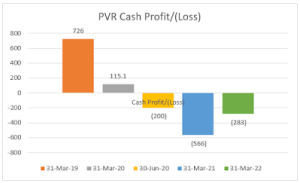

Its loss

might peak out at Rs 566 Cr by the end of this FY 2021

But the fact

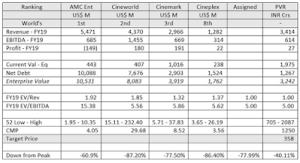

remains that – at the CMP of 1250 and FY 21 fwd PE of ‘maybe’ 1000, this is the

most expensive stock on the planet beating Tesla dry and hollow and far ahead

of its global peers such as AMC, Cineworld, Cinemark and Cineplex most of which

have corrected by 60-90% while PVR is being distributed to the minority and

gullible retail shareholders. (As there is absolutely no

certainty on quantum and timing of full recovery, we have used Trailing numbers

to benchmark globally. Also, a size discount is applied)

Going by

these calculations and benchmarks, PVR (ceteris paribus) while deserving its

rich valuations should slide down to under 400 when its performance, reasonable

valuations meets to say hello to its eventual fate.

Minority shareholders singed by the narrative built around a stock always

almost are left holding a rotten tomato.

Looking fwd

to gain some confidence post this Virus, when I can again take my loving mom to

get her favorite popcorns at PVR – in the meanwhile sell the family silver to check-in

into PVR ‘only if’ there is no other show going on.

Ravi Sharma @caraviusharma ; https://www.linkedin.com/in/ca-ravi-u-sharma-65901b97/

Excellent analysis…Anyways in PRE-COVID also i never liked this stock as we hardly have 1 or 2 Bollywood hits in a year..God knows from where do they generate revenue to PE beating world stocks.

While it might look that grave but then if you believe that u wont go back to the cinema's then i agree to each bit…but then if you look at the footfalls in malls & restaurants and the lack of substaintial releases on OTT given poor visibility of monetising the content in the indian markets vs the production cost involved and loss of revenues for overseas rights/broadcasting rights/music rights/satellite rights etc it is impossible that cinema's wont see a comeback…We are very different to the developed markets here and it is subjective to assumptions for a investor…if PVR fails Inox will gain but survival should not be a question is what i think….and 300 rs for popcorn should not be a issue vs 1000 rs for a 30 ml whisky in a airconditioned restaurant….so that argument is not valid in any case

Dear Manu,

Awesome analysis and it should wake up gullible investors. You are doing a great service to them.

Sir,

excellent analysis.Without the details that i told one of dear friend cum large investor about 4 months ago.It was plain commonsense.T he stock continues to remain above 1000 and confound me.I give it a maximum value of Rs.200 based on real estate for owned space and nothing else.

Sir, I would also like your view on Bosch,considering the almost total freeze of sale of diesel vehicles (The near parity of prices of petrol and diesel causing that) and the valuation it is trading…am given to understand diesel gives it almost 50% revenue.

This article is so insightful

Retail investors don't seem to understand 'capital dilution'.Yes, the PVR brand may survive, just like Yes bank or Vodafone Idea, but they will have to keep raising money and is unlikely to create serious shareholder value.

Hi Manu and Ravi! A very interesting read. could you please explain how it is more expensive than TESLA? thank you

While I have no insights into PVR other than watching movies before that enjoyable outing was BKK put to an end by the pandemic, I don’t think the cinema business is going to get extinct as some pundits seem to be suggesting. OTT may be the new normal but has many limitations the biggest of which is the fatigue of increased indoor recreation. I don’t see a world where we will stop stepping out to restaurants, cinemas and shopping malls although all these businesses will in the short term be deeply impacted and reorganised. Also, our millennials need to watch movies together with their boy friends and girl friends and not all of that is possible in the confines of the home. So, the popcorn and nachos will eventually return with the simple pleasures of watching a movie on the big screen. Whether PVR survives with the Bijlis taking a ‘salary cut’ or the stock corrects itself on grounds of reality only time will tell….But I do hope that I can get back to the cinema sooner rather than later….

Mandeep Lamba

Nice write up! Very candid and factual dissection of the business model.

Maybe retail shareholders are expecting a 'jump' in the 'love birds' visiting PVR post Covid to maintain the 35% average occupancy 😉

Good article. Quite deep analysis. Those reading this, if finds 'aha' moment, pls make sure you invest in stock market via MF only. Not what presented is obvious, but still 🙂

What a brilliant piece.

Good Analysis… It sounds practical for any investor to stay away now and enter with atleast 50-60% discount price for PVR from here… The charisma of Mall visits and watching movies at multiplex will revive the sooner or later as the advantage watching with loved ones with popcorn or whatever is still a preference for affordable segment… OTT can never be alternative for Multiplex longer term with respect to visual treat and experience…. All the above analysis holds good for a period of 1-2 years.

Superbly described.. Thumbs up👍

I agree with your statement

Brilliant with in depth knowledge write up. Request a simillar one on Laurus, for me this entity is a big ?

Great article. But one argument here is, Netflix has been in existence for long on western countries and still the cinemas are running there. So one cannot do away with cinemas altogether seeing the OTTs have been there for quite sometime now.

Retail shareholders increasing holding in PVR is similar to what also happened in the case of Yes Bank before it went belly up!

Retail shareholders increasing holding in PVR is similar to what also happened in the case of Yes Bank before it went belly up!

Currently a lot of people expecting pvr will get customers at precovid level. But the fact is the new strain of covid will delay the recovery to pre covid. It looks risky currently

Love the depth of your research Manu and the simplicity in the way you put it. Please keep these coming.

The biggest irony and revelation after reading this article is that you and your family despite being such an ardent patron of PVR and it's F&B can make such baseless allegations without getting into details and comparing onions with apples or in laymen term you want to compare the experience of shopping at EMPORIO MALL with a local roadside SHANI BAZAAR! Why just single out PVR, there are other players as well who attempt to ape PVR but fail miserably by miles. It makes me wonder what tempted you to write this article – a paid and planned vendetta at behest of some competitor, OTTs, fund house or to vent out personal agenda. You seem to be acting as a Messiah for retail & minority investor be it writing about ITC and now PVR but these gullible people still don't understand the motives of writing such uneducated remarks for bluechip companies who have withstood the test of times for more than decades. It would be better that you stop crystal ball gazing about future of cinema and mislead people in making personal choices. If people were to believe you and the article then there would be no premium offerings at all. You mentioned Tesla in your article, i would really love to hear your views on Apple in next blog else it would prove the point that your blog is just a medium to attract more eyeballs by writing at behest of someone for minting money and nothing else.

It seems to be a personal attack on promoters’ family rather than a fair analysis of a company which gave a new life to the entire cinema industry. You can’t forget the days when single screen cinemas were going to be shut all over the world due to losses. If you see its track record, PVR has performed consistently and every shareholder has at least doubled his investments. You can’t blame the promoters for pandemic which is unprecedented in nature and has affected globally. Can you dare to write on Indian GDP and blame PM Modi for sinking of economy. I am sure you are not. If you can’t praise sincere efforts and contribution home grown Indian companies, it’s better to keep your mouth shut and don’t spread fake or half cooked facts.

Also next time when you are fed up with your indoor entertainment and OTTs offerings, I would be delighted to see you and your family at Golchha/Delight cinema at Daryaganj enjoying their stale samosa and sugar loaded cutting chai!!

Lastly – your analysis makes me now think that Indigo and Spicejet are also F&B companies which just happen to own some aircrafts to pursue their interest of flying in air.

Manu,I really want to debate with you on this if really be given a chance.

My best…..A PVR passionate patron