simplistic form says ‘The fittest survive and they fight to compete, survive

and procreate’

generations where economic progression, education and character have all moved

in a synchronous manner. Some of the most developed economies like the US, UK

and France have had their fair share of tribulations such as wars, diseases etc

but have demonstrated that they maintained their financial, military and

intellectual hegemony from a global perspective.

Societies in the first world

Societies in the first worldcountries prided themselves with superiority and there was a race among these

nations to establish themselves as a leader in one thing or the other.

Inventions (technological, financial and medical) of every form happened in the

western world.

miserably, when evolution of homo-sapiens happened almost at the same

rate/manner across the globe.

“Corrupted Greedy Character”

was the natural evolution of a nation where its large population zealously

procreated and grew roughly 4 times from 350 mill to 1.3

billion in just 65 years.

present character of this nation. Or at least his theory explains this at best.

causal factors.

kinds of demographics Rural-Agrarian and Urban-Corporate.

limited means, producing and consuming and storing for the proverbial

winters/rainy days – Simple.

small over populated cities with limited resources and infinite greed among themselves

to survive, grow, hoard and procreate. Another phenomenon happened in the

Indian sub-continent in the last 50 years. Indians were primarily fighting

floods, droughts and starvation and suppression in the last 300 years, but the

last 50 were marked by rapid economic developments, lesser vagaries of nature,

economic development led by rapid and almost alarming shift from agrarian to

services based economy and a large part of urban population having marginally

more than required.

it the gene X) still continued to exist and despite the rapid progression, in

last 50 years, on all fronts namely economic, medical, food, transportation and

habitation, the gene X that encourages to hoard, be greedy and survive at all costs

and mostly at other’s expense, persisted and didn’t mutate at the same fast rate

as the economic development of this sub-continent.

till they are proverbially full (read bursting after a meal). They are

generally a dissatisfied lot wanting more than what they deserve or can

actually earn. And that explains why inspite

of being a rather superior nation on many fronts, this subcontinent still

behaves primitive, back stabs, in-fights on trivialities and sadly the educated

in the so called corporate world spend majority of the time pulling the other

one and the surrounding ones down because of a misplaced sense of depravation

and insecurity that purports corruption, greed and above all ‘obstruction’.

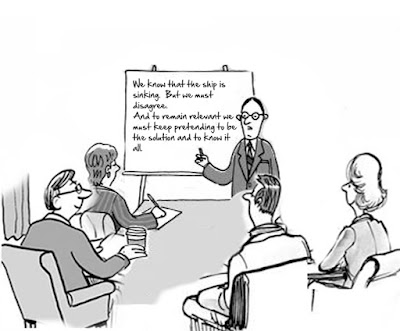

‘Chief Obstruction Officers” in the corporate world too. Fair warning pls – no COO should feel attacked –

we could even call these assets – Chief Business Obstructers or Chief Financial

Obstructers. They are all the same. For brevity lets just stick to CBO’s

defined the expansion of bureaucracies in an organisation and how work aligns

and expands itself according to people available for its completion and

organisations are perpetually insecure. Every insecure company necessarily wants to have

infinite multiple layers of inefficient CBOs to keep an alleged check and

balance.

CBOs play in the fate of organisations.

handled a business in its true sense. (the corner shop paanwalas are better businessmen

because they invest their own money and have a skin in the game). CBOs pretend

to be confident, very knowledgeable, stretched on the chair as if on a hammock

(during an official meetings – but that’s a body language that hides

inferiority in the garb of stretched posture), their condescendence and pretentiousness

would put thought leaders such as Kotler and Prahlad to shame

people from disparate backgrounds, accidentally landing themselves in position

of authority, pretending to be Prahalad’s reincarnation, aspiring to make a

mark without an iota of responsibility, assuming authority because no one

questions, pretending to have a connection with GOD (when God least cares),

and then start preaching on topics and industries – of which they have no

knowledge.

A friend

was sharing his personal experience when he used to run a business that grew 5-6

times in 4-5 years. Customers were happy, colleagues were thrilled, profits

were good. So much so – the growth rates encouraged his company to start

thinking IPO. Nothing gives an executive more joy when peers in the industry

start talking about small businesses that become a formidable force and

everyone starts talking of these small businesses as the next big thing.

Enter –

“The Chief Business Obstructor”

world is funny – everyone pretends to abide by Thomas Bertman’s adage “don’t fix it – if it ain’t

broken” yet no one practices it indeed. On the contrary system gives authority

to incompetent people who know nothing about a business and these wise men try

and fix every single thing that’s not broken – till the business is on its knees, is on ventilator support and

eventually breaks down.

examples of excellent businesses that tried to do a lot when nothing was

required to be done and businesses and leaders who did nothing when a surgical intervention

and action was required.

signs that leave a trail of evidence, sometimes discovered much later (similar

to the tail effect of a comet) when its too late, that sow the seeds of demise

of well run, well managed, perfectly fine companies irrespective of their size.

level executives and have endeavoured to summarise below the signs we must look

out for – if we care for the longevity of the companies.

- When setting up businesses

do not allow the old loyalists from other divisions (who have no freaking clue

of the new businesses) to opine. - Keep things simple –

Product , Market, Marketing, Sale, Customer, Customer Service. This is all that

matters. Anything beyond that is all farce. - Always almost make your

projections keeping a buffer for difficult and unexpected times. Microsoft

excel is a wh@#e – you can titillate it to whatever extent. It almost

always fakes in real life. - Every executive who leverages the company, must be locked in (by hook or

crook) into company’s employment for the length of the debt. Else the promoter

will be left with the hot potato at the end while the executive would have

taken his/her hefty bonuses and digested. Does this sound like Fuld? - Executives who fix up

meetings 4 times a week on disparately different subjects – Weekly updates, strategy

for the week, strategy for the month, long term strategy probably need to be

fired immediately because they have nothing better to do and are only trying to

establish their relevance at the cost of some other business and someone else’s

time. - There is a trend to ask

for weekly monthly and yearly cash flows week after week after week as if the

flow of cash is the living account of the flow of bile of the Chief

Business Obstructer. - To establish their own

importance, some CBOs suffocate the businesses of cash to an extent that their

artificial importance gets established as if they are The Fed and 90% of the time of

the business is spent in making excel sheets or symbolically accounting for the

CBO s bile. - When reviewers start commenting

on everything that they don’t have info about and keep showing the business and

its CEO in questionable light just to justify ones’s 8 figure salary and

pretend to be custodians of the business – pls definitely get wary. - CBOs ensure that the

business doesn’t have enough money to even pay its salaries while they are

happily gloating in the warmth of their annual bonuses and planning trips

across the globe. - CBOs unleash a volley of

20 something’s analysts, seeking

data from companies with the sole purpose of making themselves and CBO’s look

like saviors but in reality setting a rot of mission fatigue within the

organisation. - Pretend to be owning the

business at someone else’s expense, without investing a penny and feigning

ignorance when shit hits the roof and finding someone else to blame.

The few reasons why a handful of

businesses have survived over ages are – when..

- Owners and CEOs have

trusted a handful of performing executives over long periods of time. - Businesses aren’t judged

week on week but are judged year on year and brand-on-brand and

reputation-on-reputation and happiness-on-happiness (teams and customers) - Owners don’t allow

fraudulent people with all authority and no responsibility to exist in the

system without any measurable accountability. - Owners call-out the fakery

by converting the hefty bonuses into equity and making these well-wishers participate

in the success/failure of the company. - The fundamentals of

running a business are kept simple where cash is king and debt is death. - Businesses aren’t enamored

by the western style of cash flow discounting and valuing the future elusive cash into

present ongoing party. - HBR in a series of popular blogs have lauded the Indian baniya style of doing business and has given an infinite importance to collaborative culture and care for all.

- Businesses are managed

with lean teams that are empowered and productive and not meeting 10 times a

week to discuss strategy when none really exists. Take for instance Berkshire

Hathway’s office in Omaha that manages 510 Billion in marcap of businesses with

a handful of 25 employees. - And lastly….

- Rather than reinventing

the wheel of management styles – unconditionally back the performers, remove

the flab and rapidly weed out the fakers.

The mostly commonly used words these days are fraud and fake..

Gupta has nicely summirsed.. the falseness prevalent in corporate management of projects. The truth laid bare.

Should be shared with the B school boys..

Keep writing Sir..

Succinct & ironical that the CBO are blissfully unaware of their redundancy but big corporate giants would be ostriches if they dont downsize and take strict action on attrition in this age of the …If u dont mind me adding to the CBO a special footnote….CBO-LITAOTS …CHIEF OBSTRUCTING OFFICERS who LIVE IN THE AGE OF THE STUPID !!

Bravo Manu

Succinct & ironical that the CBO are blissfully unaware of their redundancy but big corporate giants would be ostriches if they dont downsize and take strict action on attrition in this age of the …If u dont mind me adding to the CBO a special footnote….CBO-LITAOTS …CHIEF OBSTRUCTING OFFICERS who LIVE IN THE AGE OF THE STUPID !!

Bravo Manu

On the CBO's of the world I agree, hope many people would read your piece and afflicted businesses will take note.

While I agree to some extent about your biting (almost angry) comments on the average Indians…I would have liked you to delve deeper to understand the possible causes that resulted in who we are…for example the ruthless suppression of Indian industry, of age old business practices, economic systems, trade centres and local trade in general by the British for nearly two centuries….famines were not entirely caused by natural means….and affect of the same does take generations to get rid of….even in 21st century we speak of 'rukhi sukhi roti'… because that's what many of our ancestors hoped for daily…and, unfortunately many still survive on the same….

Of course some businesses thrived; many businsses built on money lending, salt, indigo, jute, cotton, opium trade under the protection of their British bosses (and sometimes partners) today are MNC's..

Perhaps another piece with a historical perspective?

Very well written and well analysed

This is really awesome Manu. I’m sold on point 2 and resonate with everything you say. The minute the corporate jargon is out, my hackles are up !!

Big fan of your writing sir. We Try to incorporate every bit of your advice in our small business.

Thanks for your personal marvelous posting!

I truly enjoyed reading it, you happen to be a great author.

I will ensure that I bookmark your blog and will come back

later on. I want to encourage you continue your great

posts, have a nice weekend!

Thanks for your great and helpful presentation I like your good service.I always appreciate your post.Excellent information on your blog, thank you for taking the time to share with us.I’m really amazed with your posting skills as well as with the layout on your blog site.

chief sales executive

Your blog is very informative. Eating mindfully has been very hard for people these days. It's all because of their busy schedules, work or lack of focus on themselves. As a student I must admit that I have not been eating mindfully but because of this I will start now. It could help me enjoy my food and time alone. Eating mindfully may help me be aware of healthy food and appreciating food.

persoonlijke ontwikkeling amsterdam

It is really a helpful blog to find some different source to add my knowledge. I came into aware of new professional blog and I am impressed with suggestions of author.startup amsterdam