My first stock market investment was

in year 1992 when my dad gave me some 100 shares of indo gulf fertilizers and I

remember it was a bad trade as I traded all my life savings of Rs 17000 in a

savings account to the then market price of those 100 shares that was Rs 7600.

in year 1992 when my dad gave me some 100 shares of indo gulf fertilizers and I

remember it was a bad trade as I traded all my life savings of Rs 17000 in a

savings account to the then market price of those 100 shares that was Rs 7600.

But laissez-faire prevailed and I got a share

certificate with a green transfer form attached to it. I still felt nice and

confident because I saw an opportunity to learn the nuances of stock markets at

17 and make sense of those 2 pieces of paper.

certificate with a green transfer form attached to it. I still felt nice and

confident because I saw an opportunity to learn the nuances of stock markets at

17 and make sense of those 2 pieces of paper.

How those 100 shares panned out in

life is a matter of another piece at a different point of time but for the

record that and all additions of life earnings added to timely systemic investments as

on date have returned 17.8% CAGR since 1992.

life is a matter of another piece at a different point of time but for the

record that and all additions of life earnings added to timely systemic investments as

on date have returned 17.8% CAGR since 1992.

Someone tried hard to sell me the

Someone tried hard to sell me thePortfolio Management Scheme of MotilalOswal

12 months ago claiming that they have consistently returned 38% to their

investors since inception. Financial advisors and relationship managers have a

unique ability to make muppets out of gullible investors

for whom a marginal delta in comparison to the AAA rated securities means the

world and 38% is as good as it can get.

More amusing was, that, my research

revealed that Warren Buffet’s life to date CAGR has been close to 20% and

Motilal and its agents claimed a CAGR of 38%. I closed my eyes and visualised

Buffet serving tea to Mr. RaamDeo Agrawal and Mr. Motilal Oswal if they have consistently

been able to beat the Buffet hurdle.

revealed that Warren Buffet’s life to date CAGR has been close to 20% and

Motilal and its agents claimed a CAGR of 38%. I closed my eyes and visualised

Buffet serving tea to Mr. RaamDeo Agrawal and Mr. Motilal Oswal if they have consistently

been able to beat the Buffet hurdle.

Of course I never invested in Motilal

or any of its alleged schemes but did keep a track on their presumptions and in

July 2016 when they came out with a public research report on a share

called manpasand beverages and a follow up report reiterating their

stand in May 2017 and eventually in Jan 2018, I bought some shares

only to follow and keep track. Look at these reports and you would have wanted

to sell your house and invest in their recommendation.

or any of its alleged schemes but did keep a track on their presumptions and in

July 2016 when they came out with a public research report on a share

called manpasand beverages and a follow up report reiterating their

stand in May 2017 and eventually in Jan 2018, I bought some shares

only to follow and keep track. Look at these reports and you would have wanted

to sell your house and invest in their recommendation.

Cut to May 2018, Manpasand Beverages is down 72% from its price, has eroded an ocean of

investor wealth and small gullible investors are left holding their MTM losses

in the hopeless world of being treated as muppets.

investor wealth and small gullible investors are left holding their MTM losses

in the hopeless world of being treated as muppets.

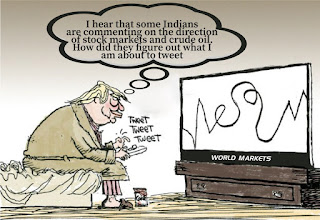

Recently I was invited to join a

concall addressed by the same Mr. Raamdeo Agarwal as he was opining on Crude

Oil prices. I thought WTF….. How can anyone opine on crude prices when even the

King of Saudi Arabia might be clueless on the same. In a VUCA world where a tweet by

trump can make DOW rise or fall by 2% or take crude prices thru the roof, where

a posturing by Kim where Kim fires a useless missile – roils the world markets

– oh by the way I am talking of Kim Jong

Un of Korea and not Kim Kardashian, here is an Indian commentator

commenting on the crude oil prices.

concall addressed by the same Mr. Raamdeo Agarwal as he was opining on Crude

Oil prices. I thought WTF….. How can anyone opine on crude prices when even the

King of Saudi Arabia might be clueless on the same. In a VUCA world where a tweet by

trump can make DOW rise or fall by 2% or take crude prices thru the roof, where

a posturing by Kim where Kim fires a useless missile – roils the world markets

– oh by the way I am talking of Kim Jong

Un of Korea and not Kim Kardashian, here is an Indian commentator

commenting on the crude oil prices.

So when I asked him whats his

accountability on Manpasand, because I invested my entire bonus and savings on

the basis of his company’s research report, he was flustered and advised me

that the concall was on Crude, refused to take ownership of his company’s recommendation

and gave me the contact of his head of research Gautam Duggad. (GD)

accountability on Manpasand, because I invested my entire bonus and savings on

the basis of his company’s research report, he was flustered and advised me

that the concall was on Crude, refused to take ownership of his company’s recommendation

and gave me the contact of his head of research Gautam Duggad. (GD)

Pronto – I called Mr. Duggad for some

insight as I wanted a word of solace and advice as to the way forward to an

investment that eroded approx. 75% of my wealth entirely on his and his company’s

recommendation.

insight as I wanted a word of solace and advice as to the way forward to an

investment that eroded approx. 75% of my wealth entirely on his and his company’s

recommendation.

GD was flustered and angrily asked me who my

relationship manager was. I asked him – ‘how is that relevant. Did your

research report mention as a disclaimer that Motilal is answerable to only

those people who reveal the names of their relationship managers when the shit

hits the roof’.

relationship manager was. I asked him – ‘how is that relevant. Did your

research report mention as a disclaimer that Motilal is answerable to only

those people who reveal the names of their relationship managers when the shit

hits the roof’.

And Mr. Duggad banged the fone down

on me. I became a complete full-circle muppet. Or at least was treated like

one.

on me. I became a complete full-circle muppet. Or at least was treated like

one.

Whats the point…….

- Any financial advisor

claiming to outperform the Buffet hurdle is making a Charlie out of you. - If you are able to beat

the returns offered by bonds issued by central banks of your respective

countries – without taking a risk – you are doing fine. - Keep investing your

surplus and believe in the power of compounding rather than relying on specious

research reports by companies finding and feeding their army of muppets with

erroneous asymmetric

information. - Invest in the quality of

management rather than the sweetness or sexiness of companies like manpasand. - Capital protection is far

more important that elusive returns on investments. - Endeavouring to marginally

beat the returns offered by robust central banks will hold you in far better

stead than endeavouring to beat the inflation rates of Zimbabwe and Venezuela. - Be patient in markets –

they can be irrational on either side for prolonged periods of time. If your

holding period isn’t forever then you shouldn’t be in markets even for 10

minutes. - Don’t follow any stock

advisor blindly – Do your research and it takes no rocket science to identify

stable well managed companies. - A boring company that is

debt free, out of market favour, consistently giving dividends and growing at

about 10% YOY and definitely not recommended by analysts on CNBC on a daily

basis, is likely to give you a far better return than the sexed up companies

finding the favour of analysts on TV channels, who are themselves mostly doing the

opposite of what they are recommending on the TV. - And lastly why should you

pay 3-4% as management fees to your fund managers (who don’t even guarantee a

prevailing bank rate for fixed deposits and who play the markets on your money)

– only to lose your capital and then hear them blame the systemic issues of

markets.

Human beings have short memory and

people are afraid to acknowledge disastrous consequences of the bias of cognitive dissonance in the face of

questionable advice on business channels.

people are afraid to acknowledge disastrous consequences of the bias of cognitive dissonance in the face of

questionable advice on business channels.

Vakrangee, PC jewellers, Gitanjali Gems and Manpasand (these can be all googled and enough information can be found online about the dubious managements of these companies) have been recommended by some of the well known stalwarts of the market and just these 4 companies have eroded close to 35 billion UD Dollars of shareholders wealth in less than last 90 days.

Try doing exactly opposite to what

the commentators recommend on the television. You are likely to make more money

than by following their advice.

the commentators recommend on the television. You are likely to make more money

than by following their advice.

Someone needs to be eventually hanged

for this. Whether it’s the fraudulent promoters or the overzealous self-serving

analysts.

for this. Whether it’s the fraudulent promoters or the overzealous self-serving

analysts.

The decision entirely rests with the muppets.

Manu also writes for The Huffington

Post and can be contacted on mrg45@hotmail.com

Post and can be contacted on mrg45@hotmail.com

Lovely Article as always you hit the nail on the head

Good article as always Manu. Any suggestions on companies one should look at that fit your criteria?

Great to read you again. Keep writing on this topic as there is a world of financial disinformation out there.

Manu Bhai. Well written. I forwarded it to my investment consultant.

Once my mentor (who is a heading a PE) told me that, if any one is offering you even 1% more return than the Government Bonds, then it is not a risk free investment. Rather risk comes free with it.

His logic was simple. If any fund house /PMS offered so called consistent returns then the entire world’s money should be flowing to this PMS. They would not be coming to you to sell their product.

As you rightly elaborated where a man worth USD $85 Billion would be serving tea to Mr. Agrawal & Mr. Oswal and would have invested his billions through them.

Many PMSs have visited me to sell their product. One thing was always consistent, their product was always No.1 supported by statistics with 3 Months, 6 Months, 1yr, 3yr, 5yr statistics. However when confronted by the data of other PMSs says otherwise they had ready answers.

One thing that I have learnt is “Not to put all eggs in one basket”. One basket may fall and break, while eggs in another may not hatch at all and one of the baskets may give you golden chicks 😊

Someone needs to be eventually hanged for this. Whether it’s the fraudulent promoters or the overzealous self-serving analysts.

The decision entirely rests with the muppets.

Hahahaha hahaha….for a purveyor of "use and throw"…and screwing your friends.. over the greater good of your monthly paycheck and the deepthroating required for passing the XL game..I love your chutzpah..

For a parvenu immigrant your doing a amazing job ..more power to you

Bcc..

As promised

I like the way you tied all the information together. You certainly touched on some key points.

Commodity Tips Provider Indore

Thanks for sharing such a great blog Keep posting.

b2b data providers

contact database

data provider

business directory

relationship intelligence

crm software

Well Said, you have furnished the right information that will be useful to anyone at all time. Thanks for sharing your Ideas.approved auditors in dmcc

Thanks for sharing a nice article post. It’s a very well-defined article. You can visit here for Learn Forex Trading Step by Step in Mumbai