Quarterly Magic of ITC

Numbers

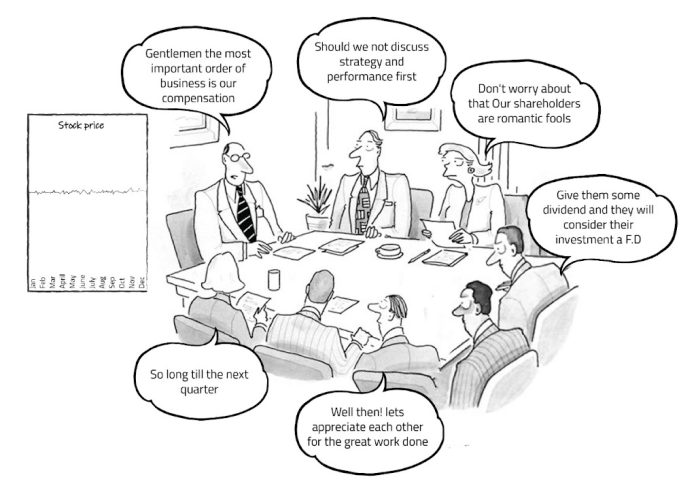

The

greatest trick the devil ever pulled was convincing the world he didn’t exist.

And looking at the way ITC is managed, it can be said with reasonable certainty

–

The greatest trick the ITC is pulling is to convince its shareholders that its

board exists and is indeed responsible for the company.

The

alarming regularity with which the stock price is manipulated weeks before

every quarterly result, the rumours about the demerger, stellar results round

the corner, special dividend in the offing and buyback, only to be disappointed

quarter after quarter – is nothing short of a movie plot. The retail

investors also known as the hopeful romantics within the ITC

fraternity, keep buying the stock, while Wealth Managers across the country

have created an entirely new and risk-free business model of selling ATM call

options month after month and making a killing, as they exactly know where the

stock is going – NOWHERE

Here’s

the secret Y’e stupid shareholders of the ITC

ITC

will never ever demerge its businesses as the present comfort of the high tide

that hides all the executives that are swimming without pants will get exposed.

The cash machine that ITC is, through its cigarette business is good enough to

keep the party going for a very long time.

And

no one likes the party to end isn’t it?

When

I wrote this

piece some 8 months ago asking some pertinent questions to the board,

the least they could have done was to gather some data, do some math and

respond with a sound and logical rebuttal or future strategy, especially when

thousands of shareholders resonated with my thoughts all over the

world, but obviously rebuttals require courage, facts, demonstration of intent

and a clear conscience – all of which seem to be missing in ITC.

Can

we even begin to imagine if ITC was managed / owned by Mr. Ambani or Mr. Adani

how happy we minority shareholders would have been? Or if the representatives

of SUUTI, LIC and a few Mutual Funds along-with BAT could discover their spines

jointly, and make the management answerable – ITC has the potential to be one

of the best companies in India. But alas….

So while the latest investor

presentation used the word robust 31 times and growth 41 (the same is missing

from actual performance), it has no mention of shareholders, reduction in

executive compensation during the pandemic year but they did try and take

credit of reducing “controllable” fixed costs. Fixed costs are uncontrollable

and that’s why it requires serious executive courage to control them.

Controllable Fixed costs? – Are you kidding me?.

At

a time when the entire listed corporate world has left shareholders spellbound

in the last 15 months, with appreciable reduction in costs, stellar EBITDA

margins, efficiency not seen in the last decade, ITC has at best established

itself as a mediocre company with a mediocre P&L, poor decision making and

afraid of taking any meaningful steps that are value accretive for its

shareholders. –

details later here…..

The

talk of a robust dividend yield is akin to shifting money from one pocket to

the other because the board doesn’t have the courage to declare a buyback for

the fear of losing control and were gleefully diluting the value of minority

shareholders till recently, when BAT put an end to equity dilution

through issuing

stock options in year 2018. Since then, the company has changed its policy

and it gives Stock Appreciation Rights (SARs) which entails more cash-outflow

for the company. We aren’t sure that the principle of ‘High Water Mark’ is being

followed to ensure that SAR isn’t brought lower to adjust to the stock’s

abysmal performance.

Isn’t

it surprising that the top management of ITC, despite generous grants of stock

over the years, owns less stock than perhaps me and my family and are selling

their stock with alarming regularity. So much for the confidence in their own

executive abilities. The issue of ESOPs and quick-sale

data is available here.

Fun

fact : Just top 282 employees of ITC sold shares worth 1024 Cr in the last 3

years. And the top 10 sold shares worth 190 Cr. The real KBC is

being played here at the cost of minority shareholders.

SEBI

came out with a bold skin in the game reform for the mutual fund managers

by mandating that a minimum of 20% of the compensation of

mutual fund managers and other key personnel in an asset management company

(AMC) should be in the form of units of the mutual fund schemes they manage..

I

wrote a recommendation piece about the same some 3 years ago and when I heard of this reform,

I was pleasantly chuffed about it. I am proposing 2 more reforms and will write

to SEBI soon that :

a. Companies that don’t have a promoter

shouldn’t allow its executives to draw a compensation beyond a pre-defined

threshold and all other compensation should only be in form of dividends generated

through restricted stock options monetizable only upon end of employment.

b. The other skin in the game reform for

promotor-less companies where the promoter or the KMP has less than 20% stake

should definitely have a representation of minority shareholders on the board

and that too in the proportion of their stake.

That would indeed be another set of

‘skin in the game reforms’ for promoter-less corporations.

If

this would’ve been the norm and discipline, one celebrated CEO of an American

corporation wouldn’t have been allowed to fly fresh salmon from Norway for

lunch in the company’s private jet. The folklore has it that he was terribly

fond of Salmon.

But

lets get back to the recent stellar quarter of ITC and study the ‘FMCG giant

in the making’ narrative:

1. Companies that make significant growth, report

their numbers in absolute numbers

and the ones that enjoy growth on the base

effect of extreme underperformance only talk in percentages.

2. While Marico (Sales up – 10% y/y, PAT up – 15% y/y), Britannia (Sales up

– 13% y/y, PAT up – 33% y/y), and Dabur (Sales up – 10% y/y, PAT up – 17% y/y )

grew at a remarkable pace, ITC sales de-grew by (2%) and PAT de-grew by (15%).

ITC has almost become like a few other PSU Banks where “the worst is behind us”

and “the future is bright” narrative is being peddled for years, quarter after

quarter while the balance sheet at the cost of tax payers needs to be

recapitalised ever so frequently and here in the case of ITC, the minority

shareholders are underwriting the underperformance.

3. Further

its pertinent to note that a large part of the FMCG growth came from a very

very expensive acquisition of Sunrise which means that for every Rs 1 of

growth in revenues, the shareholders paid Rs 4.

4. Remove the Sunrise acquisition, and the revenues from Aashirwaad

atta (where the EBIDTA margins are negligible) the real growth would be much

lower.

5. “Value

Accretive M&A” is a meaningless metric until ITC acquires another company

that’s trading at cheaper valuations than itself. And thereby creating some

shareholder value. M&A at the cost of free-cash that generates lower ROE

than treasury yields is nothing short of financial hara-kiri.

6. Recently

a new kid on the block – Rossari Biotech trading at 80 PE acquired Unitop

Chemicals trading at 10 PE (just an example). But ITC is the only generous and

philanthropic organisation that itself barely manages to trade at 19 PE but

acquired Sunrise at 38 PE. So much for its negotiation ability and size leverage.

7. ROCE

of ITC has been dramatically falling. In just last 5-6 years alone the ROCE has

declined from 50% to just 29%.

8. With

a consistently falling EPS and ROCE the cash generation will likely not keep up

with the abysmally low shareholder expectation of atleast earning dividends

that match treasury yields and ITC will be forced to dip into their cash

reserves thereby weakening the only reasonable moat around their balance sheet.

Hotels

division can single handedly bring the entire ITC down. Someone from the

industry recently informed me that ITC keeps building hotels because one

(deceased now) earlier Chairman liked hotels. Wow that’s some real compelling

investment argument to destroy shareholder wealth. ITC hotels hasn’t been able to

develop its own distribution network in so many years and relies on Marriott

and Preferred for its booking engine and loyalty program. And it talks of

creating a world class brand.

Allow

the powers that be in the hotel division to raise funds, deal with financial

institutions, consider capital an expensive and rare resource and then make

investment decisions and only then gloat in the glory of making green hotels

and winning global awards. Every investment and every new hotel would then seem

like a wasteful expenditure. But then the past Chairman liked hotels……..

If

managers don’t have the ability to raise and manage capital and understand the

concept of ROCE, then either the managers need to be replaced or the businesses

sold off.

Rather

than trying to acquire Oberoi hotels (through the present 14% ownership) for

the purpose of empire building, ITC should sell their hotels to some global

hospitality chain that has the edge of a superior global brand recall and a

distribution network. That indeed would be value accretive for shareholders.

All

the We-assure and the marketing campaigns that the hotel division indulged in

couldn’t prevent an outbreak

in the Chennai hotel when the entire hotel had to be shut down.

Marketing is good, but gimmicks are misleading especially in the face of the

ferocity of Covid-19.

If

hospitality was a separate division, the mettle of the managers would have come

to fore and perhaps the expression “house of cards” would be exemplified if

they would have had to raise working capital through ECLGS, deal with financial

institutions, institute meaningful salary cuts and worry about cash to sustain

rather than dip in papa’s pocket whenever money runs out.

Can

we – the minority shareholders know the equity invested and ROE (return on

Equity) only in the Hotel division alone please?

The

segment assets of 6,525 Crores (post an approx. 30 yr opportunity cost)

tantamounts to approx. equity worth more than approx. Rs. 50,000 crore

destroyed in hotel division alone. And we aren’t even talking of

Capital Work in Progress that will further erode the shareholder wealth. This

money over 30 years with any half-wise capital allocation would have added

atleast Rs. 2-3 lac crores (26 – 39 billion USD) in market cap alone

FMCG

business grew at 23% for the year but the EBIT that should have grown better or

more only grew at 11% resulting in EBIT margin going down from 8% to 7% (Poor

operating leverage). Does that mean that there is a possibility that Agri

margin is being sacrificed to prop up the margins of FMCG business through

transfer pricing tricks thereby misleading shareholders?

Or does this mean that the company has no clue or understanding or internal

controls to increase operating leverage??

FMCG

– Peer Group Comparison

Now

if there was a my-baap in ITC these numbers would have been

treated like murder – but we have no doubt that the powers that be in the FMCG

division would not only have got ample pats on their backs but also huge

increments and ESOPS (needless to say – value destructive for minority

shareholders)

All Hope isn’t lost

While

much has been debated about ITC’s strategic decisions on business ventures,

capital allocation and performance of the businesses, all hope is not lost as

company can alter its approach and enhance shareholder’s value through a few

short term and long term initiatives which are presented below –

While company has created admirable properties across India, The present

management neither runs these with any sense of ownership (would have been

reflected in the numbers else) nor do they take decisions that are prudent in

the interest of shareholders.

Due to the evolving dynamics of the industry, hotels are not

value accretive as these have very long gestation periods. Further, the

pandemic has grounded even the most ardent believers of face-to-face meetings

and have compelled them to adopt the ‘new normal’ of Zoom and WFH, and this

trend will permanently impair business travel as demand side will dramatically

drop.

provides a great opportunity to sell the hotel division ‘NOW and HERE’ rather

than continuously bleed the consolidated B/S and putting good money after bad.

If the

wishes of the past chairman are so dear, then reimagine the division to make it

profitable and figure out WHY (do we exist), HOW (will we

prosper) and WHAT (needs to be done).

Value Unlocking:

a)

Demerge the business which will bring financial discipline and bring

more accountability as mentioned earlier

b)

REIT – Develop a REIT structure, divest stake in the business to a

global alternate asset manager who is looking to lock capital for a longer

period to time. All the owned assets can be transferred to a separate trust and

properties could be leased back at an attractive yield. Not only would this

make the managers accountable, as they would have to earn to pay the lease, but

also this would unlock the shareholder equity to the tune of approx. Rs. 25,000

crores and thereby become an efficient Operating Company (OpCo)

Or

c)

Sell all the owned assets to strategic players i.e., global hotel chains

to focus on Cigarette and FMCG business.

d)

Become a Property Company (PropCo) and get some of the best global

operators to manage hotels

2) FMCG –

Building FMCG companies from scratch can take years. The company has done a

commendable job in building some widely recognized brands by channelizing its

strong distribution network. However, ITC has high volume and low margin

businesses, and products are largely ‘Me too’. If the company were to achieve

Rs. 100,000 crores target by 2030 (Vision

statement) the top-line of FMCG should grow by ~23% in the face of

cigarette sales degrowing by 5% YOY over the decade which is much higher than

the present 13% growth rate. But I am sure ITC is managed by magicians and this

growth wont be hard to achieve. We have faith in the magical powers of the

executives but pls don’t behave like a minister who recently, famously said –

“don’t go into numbers and don’t do math” have faith.

Tatas, Ambani and Damani are all getting into D2C and private

labels to create an edge. Use the power of your network to take advantage of

the large fortune at the bottom of the pyramid rather than wasting time selling

some expensive chocolate that will remain unprofitable. If ITC doesn’t evolve

or acquire (not at Sunrise valuations) some new-age businesses, it faces an

existential crisis in the modern well connected e-world.

Strategy:

a) Product

Innovation/Creation of category: Stop

being a me-too company through Yipee and Sunfeast biscuit. Create a new game-changing

category.

Tell me the second man on the Moon and the Everest – no one

knows them. And ITC should stop being a distant No.2. Unless ITC gets its mojo

to create and sustain a category, it has no future.

b) Spotting

trends early: While market share gradually

shifts from unorganized to organized, it is a multi-year process and this

seldom results in high margins. Few of the interesting areas that look

promising are Frozen food market, Adult Health & Nutraceuticals,

Cosmeceuticals etc.

c) Geographical

Diversification: ITC is ITC – don’t allow

regional players such as Adani Wilmar to

weed you out. Get your act together or you wont exist.

d) Contract

Manufacturing: Demonstrate the power of

the ITC brand to outsource a large %age of products to contract manufacturers

and free up capital. ITCs incessant desire to do all-by-myself is hurting its

shareholders.

3)

IT Services –

Demonstrate the ability to become the Larsen and Toubro Infotech or

stop pretending to be an IT company and allow the super-efficient Board to be

distracted. There is no way that ITC Infotech can ever become anything

meaningful or it would have already become.

4) Cigarettes and

general – As the capex requirements are complete, the company should return the

money to the shareholders in form of buybacks. Rs. 60,000 crores buyback can be

planned for next 6 years, utilizing existing bank balances and the rest through

borrowing. Theoretically, if the earnings yield is more than the post-tax

borrowing of the company, the company should do a buyback until such time that

palatable debt is reached. Debt magnifies RoEs and buyback reduces the equity

base, both done today maximizes returns for shareholders.

But

that would mean sacrificing a bit of control to BAT – but Boards that

mean well for the company and its shareholders think beyond the virtues of

selfishness and control freakery.

Overall –

1) Selling Non-core assets –

Small business should be sold or shut down. Stakes held in other hotel chains

should be sold at optimal valuation as of yesterday.

2) Shareholder

Communication – Company of this size

should have analyst concalls, provide definitive guidance on the numbers. (the

way Infosys does)

3) CAPEX Guidance –

Company of this size should declare its capex plans so that it can be built in

pricing of financial models.

And above all

4) Appoint Minority Shareholder Directors –

The company should onboard an eminent small shareholder director with a

relevant experience so as to amplify the importance of retail shareholders as

well.

A family can never be fatherless. And if it is – the minority shareholder

should become the deemed one.

When someone posts an opinion or an

article on ITC, the emotion and response that it generates is overwhelming. If

the true meaning of Stockholm Syndrome needs

to be understood, delve deep into the mind of an ITC shareholder – That’s the

Enigma of ITC.

During

my hospital visit to look upon someone some years ago, I learnt that the ECG

monitor of a dead person is just a straight line. ITC stock price graph reminds

me of that line I saw years ago because the price is more stable and straighter

than that line.

Long live ITC…..

I have never been able to understand, why ITC runs hotel business.

Pretty neat write up… in the world of massive competition, people need to be tasked. It’s seems the management here is the most lethargic, aimless and lacks any ambition to do better. Rather it’s criminal the way they are issuing ESOPs to themself and selling it soon after. Insane!!

👏

ITC is like an orphaned teenager whose parents have left him loads of money/assets.

It is very rare that such children go on to do something worthwhile and it is not their fault. Everybody needs a guardian (parent or anyone) to guide them.

Demerger – You said it! Management will not demerge and expose them selves to vagaries of real world without the comforting umbrella of cigarettes. Buyback is possible. If buyback is offered then all parties who want to keep their control may not surrender share. Others may avail of the buyback boosting the returns of remaining shareholders.

D Muthukrishnan (@dmuthuk) will be very disturbed with this article. He may loose his sleep for few days but i am sure he will be saying my view is for decade, price dont bother bla bla, my strength is my patience. Remember guys he created good welath in last decade and all the accumulated wealth from other stocks like Nestle, PGHH, HDFC bank, Pidilite (All dividends) he invested in ITC. I think there is no fresh cash being pumped by him in ITC. Please diversify dont follow blindly. Consider Position sizing. Even Bill gates was not knowing he was going to build a multibagger or for that matter Jeff Bezos too!

D Muthukrishnan (@dmuthuk) will be very disturbed with this article. He may loose his sleep for few days but i am sure he will be saying my view is for decade, price dont bother bla bla, my strength is my patience. Remember guys he created good welath in last decade and all the accumulated wealth from other stocks like Nestle, PGHH, HDFC bank, Pidilite (All dividends) he invested in ITC. I think there is no fresh cash being pumped by him in ITC. Please diversify dont follow blindly. Consider Position sizing. Even Bill gates was not knowing he was going to build a multibagger or for that matter Jeff Bezos too!

Awesome Article but don't expect ITC to come out of the woods any time soon.

very well written nice article

ANOTHER MASTER STROKE

Time and again, I have put these points through though not with this much of data and clarity

1. Its a written on the wall that they will never demerge because it would be difficult to carry lot of baggage of executives and higher management once demerging is done

2. If you want to see the execution capability of current chairman, you must see how ITC infotech has grown over the years. Almost nill profits

3. Easily can issue shares at their will and sell as soon as they are allotted. No one to question. Yes it can be seen in last few year easily

4. Such a big conglomerate and people complaining year after year of their products unavailability, the sales team and management resting in some ITC 5-star hotels which are for them only

5. The way acquisitions are done with no looking back at how costly this asset is wrt. present value, management looks more like a rich brat who is enjoying on his fathers money

6. Stock offcourse not going anywhere but it is a written on the wall that how the equity is getting diluted and how the company is being run, we can easily see the prices in double digits in longer timeframe

7. There are people on twitter who are being hopeful and keeping people motivated to hold this stock, same ones would boast of holding a large chunk but never has the courage to ask what exactly is going on

Buy ITC @ 208

No SL. Tgt 400-600 ��

They are fooling to retail investors.seroiusly your article has opened my eyes.

Will they read and act on advise given ?

Absolutely.. I'm happy to know that there are some people who understand the exact issue.. Lack of promoter is mother of all reasons of consistent poor performance of such a large company.. SEBI should take note of it and implement suitable regulations to guard the interests of minority shareholders..

Dear Manu, Brilliant analysis, perspectives and suggestions on ITC. My view is, it is a cabal of lazy, selfish, self-serving individuals masquerading as professional managers that are enriching themselves at the cost of shareholders. All your points around compensation; exiting hotels / IT; Me-too FMCG products; expensive acquisitions; opaque operations are very valid. I will not rule ourt corruption. Appointment of minority shareholders are a must given that there is no ownership control. Given your depth of understanding of ITC and the quality of your suggestions, I (as a ITC shareholder) would like to recommend you as a board member to represent minority shareholders. Please send through your article to BAT, and other prominent board members and shareholders including institutions and seek their perspectives on your analysis & suggestions, as well as have a specific discussion on these points in the upcoming AGM. May be a bunch of interested shareholders can write individually (but on a coordinated basis) to the larger shareholders, institutions, board members.

It looks like a old professionals' club (belonging to 80s' and 90s') who either have retired or about to retire, nicely and neatly named as Board of Directors and the top team at ITC.

Shame on ITC management. Look at the way ITC fought BAT's overtures in early 80s' and thwarted attempts by its foreign partner (of course the hallowed stories of L&T is still fresh in people's mind of that era) and now what happened to that fighting spirit and coming on great performance.

to siphon off the funds

Any reason why you continue to hold a large position in this stock (as admitted by you in the post) if so much is wrong with it? Strange choice.

There are thousands of listed companies. There isn't a single better one than this to deploy your cash in? Strange.

Wow the analysis is brilliant ! This is such an eye opener. The detailed research and writing is amazing to read!

I have one point to make and I am sure you will correct your statement.

You have written that Managers have sold 1094 Cr worth of shares under ESOP.

I have checked with one of my friend from ITC . He told me that ESOP Options are allotted at Market price on the day of allotment. Secondly , when they take Optios , option is given at the Market Price on that day .

That means ITC is giving at Market Price on the day when the employee chooses to take Option .

Considering that share price is falling from 300 to 207 , as mentioned by you , many would have lost .

Also , for taking Options , they need to sell old shares and take , as you know Employees are not Rich .and can’t afford .

So your figure of 1094 Cr is not Representative .

Secondly worldover most of the companies do give ESOP and it is nothing specific to this company alone .

Appreciable feature with this company is that they are giving at Market Price while sanctioning as well while while allotment of the Option / Shares.

I know many companies in India ,use to give ESOP at Face Value , and they are all now Multi Billionaires ,

I am also a share holder and I am also loosing. Sometimes it happens.

While I donot want to name , there were some large cap companies, whose share price did not move for a decade ,

and they are doing extremely well . Those companies shareholders were also blaming and today they are enjoying.

And ITC has given Bonus once in every 4/5 years . No other company gave .

I am not saying I am happy to loose . But I am waiting for good days to come like it has come to other big companies.

I think you should send your Recommendations to the Company . If they are useful, they will definitely implement and we all will thank you , if the share price goes up .

Rgds

Excellent analysis on ITC. Like a fool, I continue holding a good chunk of ITC holding. Several opportunities came by to sell ITC, and then again, I changed my mind believing that chart would move up due to improved fundamentals. Now the question is what is your suggestion on price movement? Since you have done such a great analysis, you would also be in a position to forecast stock price movement.

Have you even seen the Profits generated by ITC Infotech last year and this year?

I would add one more to the suggested improvements:

– ITC should add whistleblower policy in its organizations.. if minority holders don't have much to decide let someone minor in the org blow out something

Probably the most hard-hitting and pragmatic analysis I read in a while. I wish more analyses and reports had the spirit as this one here. Well written Sir!

Disclosure – You own this stock should also be mentioned at the end of the post.

This is a pure gem.

Manu saab,

I appreciate your heroic efforts to help people understand the malfunctioning of this company.

I REQUEST YOU TO INVESTIGATE A MAJOR SCAM RUNNING IN THIS COMPANY

APART FROM ESOP, HIGH SALARIES, LAVISH PERSONAL CABINS FOR STOCK TRADING, REAL ESTATE DEALS DURING OFFICE HOURS, OUR GREAT MANAGERS ARE EXPERTS IN RAISING FALSE CLAIMS AND MAKE MUCH MORE BIGGER BONUSES.

THE ACTUALs OF ALL WRONG CLAIMS IS AVAILABLE WITH ALL DISTRIBUTORS ACROSS THE COUNTRY. I BELIEVE ALL WOULD HELP YOU IF YOU COULD CREATE A FORUM FOR THIS DEBATE.

My estimation every AM would claim minimum 2 lakhs per month,ABM 10 to 12lakhs, BM would make 2.5 to 3 crores a year, DM would make not less than 30 lakhs per month. In this ratio calculate for all the employees.

This is the truth.

I pray god to some how expose this truth to the nation.

100 Cr defamation case filed by ITC on Mr Manu Rishi Gupta and few others clearly states that Company Management is so rattled by some truths that they want to ensure that no one in future should try to show them mirror. I have 2 basic questions

1) IF ITC Management things what what Mr Manu Rishi Guptha has said is In correct they should have either given Clarification or should have asked for debate.

2) By filling defamation case of 100 Crs they want to terrorise other Vigilant people to such extend to keep their mouth Shut else ITC can make you Bankrupt.

Someone was suggesting that here should be a whistle blower policy. Just Imagine if they can be so Volatile on some Blogs what can they do to an employee who even wishes to show them mirror.

Its an British Era company and they like Yes Men thats the reason why they are loosing their ground even in Cigarettes.

Not many people knew that they are ME TOO in Cigarettes also. A much smaller company by name of VST limited introduced Capsules segments/Flavored Cigarettes in India and took the industry by storm and created a new Segment for themselves. And now after 7 years ITC management has woken up realizing that this small player has become so big that VST has started hitting ITC hard in their core Cigarettes business by taking market share in UP,Delhi,Bihar and few southern markets. This can be seen from the performance of VST stocks also.

Thy lack Innovation and all their major Flag Ship brands are either on the declining stage or have reached to that level where growth in Cigarettes is Muted in ITC. Can someone remember when was the last time ITC created new brand in Cigarettes after Classic which is almost more that 2 decades old brand.

Companies grow when they Innovate or take Criticism positively.

And ITC lacking on both parameters.

Excellent analysis, I felt I learned a lot on corporate governance issues

So ITC has now filed a 100 Crores defamation suit against the writer and the owner of this blogging platform it seems.

I must admit, with my long legal career experience, such reactions by companies against whistleblowers are seen when atleast 50%-60% of what is claimed is right.

This article is really eye opening for all retail investors and it shows the efforts put in by the author to make us aware. Kudos!

They have instead filed a 100 Cr lawsuit against Mr. MRG

The post hit itc mgmt hard and they sued manu Guptha for 100 cr defamation . https://www.cnbctv18.com/legal/itc-files-rs-100-cr-defamation-suit-against-portfolio-manager-manu-rishi-guptha-for-blog-post-9977531.htm/amp

Well written and all relevant points.

Arrogant management takes down the whole company.

All minority share holders come together and teach a strong lesson to the management. Poor ITC management filed case against the Sir Gupta, rather than taking reasonable action. LOL

I already asked them about sunrise purchase,they spent 2150cr for a company who is earning 41 cr PAT.

Cost of capital is nearly 200 cr.

In next 10 year also ROCE will not surpass cost of capital of this purchase.

Why to buy companies at these price.

Why not try to buy big basket to channelize their products pan india

Bang on, Manu. No wonder, it has hit the nail on the ITC mgmts head. We should also do some shareholder activism to throw these current board out and like you suggested get some representation for the minority shareholders.

I'm no financial analyst, but it would always surprise me when I used to see thousands of stocks offloaded by KMPs

Nice peice of in-depth analysis done by fund manager.

Its basically reversion to the mean for ITC, people are fearful and hence it is the right time to buy and hold but I agree with the outrageous acquisition price of Sunrise but I couldn't have thought of a better brand at the market's lowest to go for it which is commandable job and risk taken by ITC. I think ITC should not pay dividend per share more than its EPS. I have watched an interview where Mr. Puri said how ITC Hotels are crucial backbone for development and promotion of its FMCG food business.

You did an excellent job on this post! its very helpful for all of us! Thank you!

I have few basic queries.

How a company like ITC which has so many audit systems can have so many leakages.

The way you have used terms AM, ABM, BM, DM it seems it's a chain which is running parallel system and they are making policies and are creating and using budgets for Cashbacks/Kickbacks.

But again I wonder how can a Company like ITC can have a parallel system for Cash backs. I believe they are dealing in credit notes and must be transferring claims or budgets through banking systems then how can Employees get Cash Backs?

Either their distributors/Vendors are also a part of these Murcky deals and they also get Cuts while making payments to ITC employees.

But the way ITC stock is trading indicates that these wrong doings might be happening in this Non Promotor based Comapny.

But as a matter of fact the way ITC Cigarettes are grappling to gain market shares and on the other hand Competitors like Marlboro, Four Square, Moments and Total are gaining grounds clearly indicates that Policy Makers of ITC are working for their personal gains rather than Share Holders profit.